[ad_1]

- US jobs data to steal the limelight amid worries about labour market health.

- ISM PMIs to be watched too for signs of tariff-driven price pressures.

- Eurozone flash CPI, Canadian jobs and Australian GDP data also on tap.

Will August jobs report shock again?

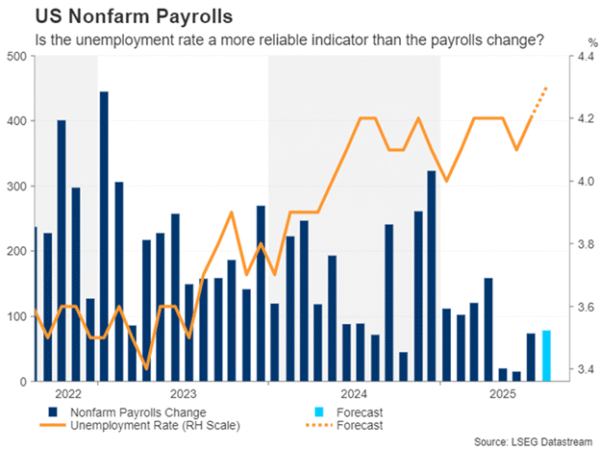

It’s almost one month ago that the July payrolls numbers generated not just considerable volatility in the markets but also a lot of controversy, as it offended President Trump’s record on the economy. Hence, the August report due Friday will be significant in two ways – will it point to a further deterioration in labour market conditions and will the data raise fresh questions about its accuracy following Trump’s dismissal of the head of the Bureau of Labor Statistics (BLS).

It’s worth being reminded that the shock in the July report wasn’t so much the miss in the headline print (73k vs 110k expected) but the big downward revision to the May and June numbers, when the economy barely added new jobs.

The no surprise in the unemployment rate was of some relief, particularly to the Fed, which has been branded “too little, too late” by Trump. But the unemployment rate is forecast to have edged up further in August, from 4.2% to 4.3%, while the increase in nonfarm payrolls is anticipated to have remained below 100k at 78k.

An ongoing softening in the labour market would not only solidify rate cut bets for September but also revive expectations of a third 25-basis-point reduction this year. In his Jackson Hole speech, Fed Chair Powell highlighted that the risks to inflation in the near term are tilted to the upside, and employment risks are tilted to the downside.

More importantly, Powell acknowledged that the balance of risks “appears to be shifting” towards the labour market. But he also pointed out that the supply of workers is slowing amid the Trump administration’s tough crackdown on migrants. This is likely contributing to the decline in new payrolls.

Thus, the unemployment rate might be a more reliable indicator of labour market strength in the current environment, and this is even before considering the recent doubts about the reliability of the payrolls survey, which Trump has claimed to be “rigged”. However, any changes to how the survey is conducted following Trump’s appointment of a new BLS commissioner will probably take some time. Another miss, therefore, could again attract some criticism from the President.

The Dollar’s surprise resilience

For the US dollar, its broader trajectory against a basket of currencies has remained unchanged despite the initial selloff post the July NFP. Unless the August numbers bolster expectations of a third cut this year, the dollar index will likely remain within its shallow uptrend.

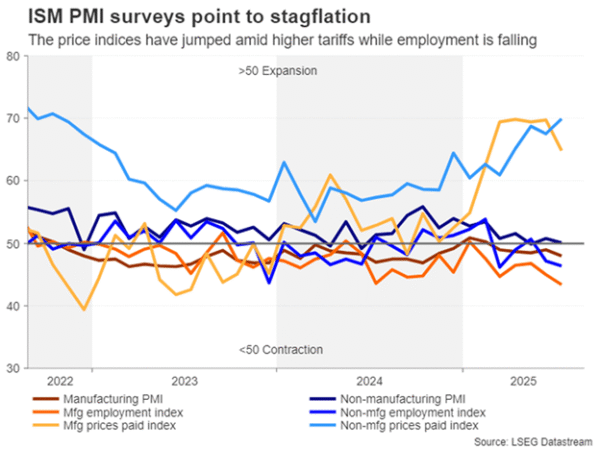

This would especially be the case if the ISM manufacturing and services PMIs, out on Tuesday and Thursday, respectively, show that higher tariffs pushed the corresponding price indices further up.

Other US data to keep an eye on are factory orders and the JOLTS job openings on Wednesday, while the ADP employment report will see a delayed release on Thursday instead of Wednesday due to the Labor Day holiday on Monday. Meanwhile, any new tariff decisions by Trump could add to the volatility during the busy data week.

Canada hoping for US tariff reprieve

One such announcement could be about Canada. Unlike Mexico, Canada failed to win an extension on the 25% tariffs on the goods not covered by USMCA. Canada’s counter-tariffs on US imports were a major stumbling block in the negotiations and Trump hiked the levies to 35%.

However, Canadian Prime Minister Mark Carney has said the country will remove some of the retaliatory tariffs as of September 1 as a gesture of good will to the US government. Should a deal to lower Canada’s tariff rate follow in the days after, the Canadian dollar could enjoy a small rally.

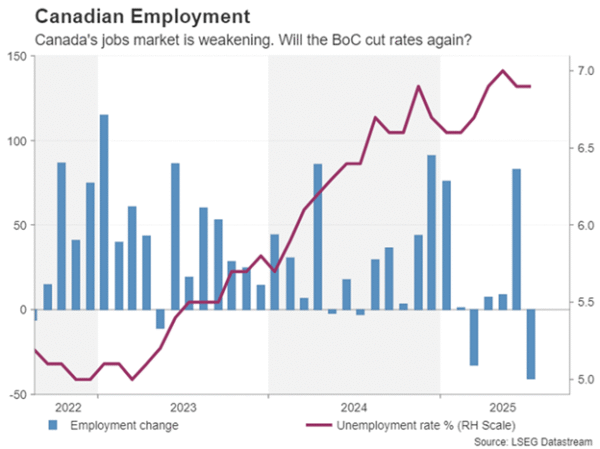

Friday’s employment report will also be important for the loonie as the economy appears to be going through a bit of a soft patch at the moment. The labour market shed almost 41k jobs in July. Another drop in employment in August could lead to investors bringing forward the expected timing of the next 25-bps rate cut, which is not fully priced in until December.

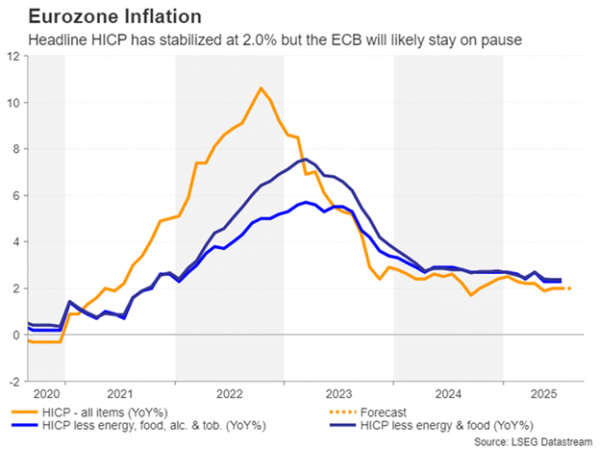

Eurozone CPI to likely confirm ECB pause

Inflation in the euro area has well and truly stabilized in recent months, holding around the European Central Bank’s 2% target for almost the past year now. The flash estimate for August is out on Tuesday and expectations are that the headline rate remained unchanged at 2.0% y/y. The core readings have steadied slightly above 2.0% and even the sticky services CPI has come down substantially this year.

The one worry is wage growth, which unexpectedly jumped to 4.0% y/y in Q2. This isn’t entirely surprising, however, when considering that economic growth has been somewhat stronger than projected in spite of the trade war.

The outlook going forward, though, will probably be slightly more difficult to predict amid the uncertainty about how big an impact the higher US tariffs will have on European exports. But for the time being, the ECB is well placed to stay on pause for the foreseeable future, with the reaction in the euro to the inflation data likely being limited.

Also on the Eurozone agenda are producer prices on Wednesday, retail sales on Thursday, and quarterly employment and GDP figures on Friday. German industrial orders for July might also attract some attention on Friday.

Over in the UK, the delayed release of the July retail sales report on Friday will be the only highlight for sterling.

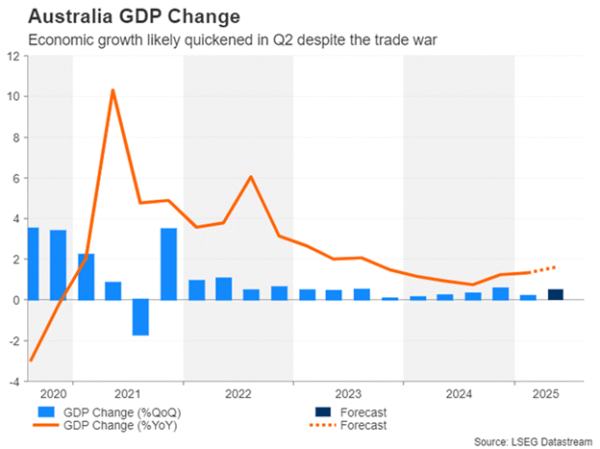

Aussie eyes GDP and Chinese PMIs

Moving to the Asia-Pacific region, Chinese manufacturing PMIs will be watched at the start of the week for clues about whether Trump’s tariffs are having a material impact on industrial output.

The official manufacturing gauge is due on Sunday and the S&P Global/Caixin equivalent will follow on Monday. Both PMIs printed slightly below 50 in July so a further worsening in activity in August could hit sentiment, including for the risk-sensitive Australian dollar.

As for domestic data for the aussie, traders will be monitoring GDP growth figures on Wednesday. The Australian economy likely accelerated in Q2 after a weak Q1. However, following the sharp uptick in monthly CPI in July, the GDP readings may not have such a huge bearing on RBA rate cut odds, even if they disappoint.

In Japan, updated capital expenditure data on Monday will be an indication as to whether the Q2 GDP estimate will be revised higher or lower. Household spending and earnings numbers will follow on Friday. With investors gradually upping their expectations for a year-end rate hike by the Bank of Japan, there could be a further boost if pay growth quickened in July.

[ad_2]

Source link