[ad_1]

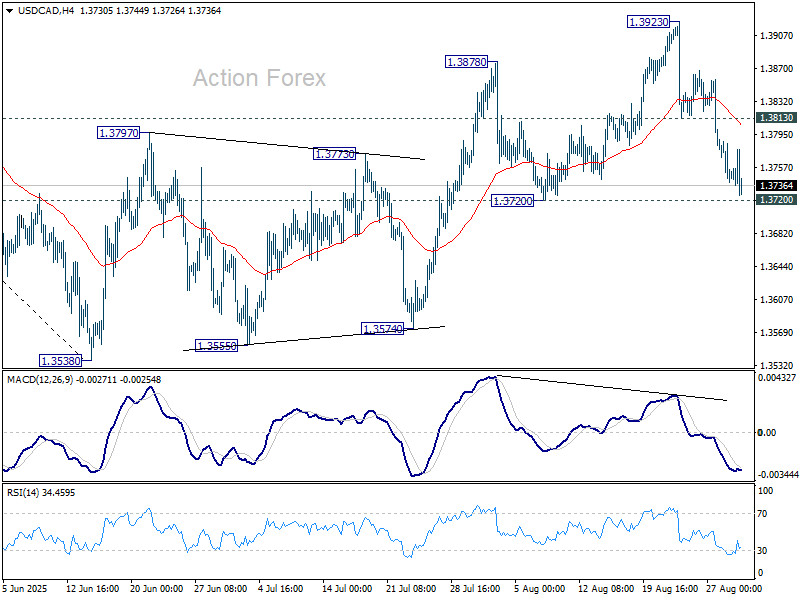

USD/CAD dropped sharply last week but still hold on to 1.3720 support. Initial bias stays neutral this week first. On the downside, decisive break of 1.3720 will argue that the corrective pattern from 1.3538 has already completed at 1.3923. Intraday bias will be back on the downside for 1.3574 support first. Break there will bring retest of 1.3538 low. On the upside, though, break of 1.3813 resistance will retail near term bullishness, and bring retest of 1.3923 high instead.

In the bigger picture, price actions from 1.4791 medium term top could either be a correction to rise from 1.2005 (2021 low), or trend reversal. In either case, further decline is expected as long as 1.4014 cluster resistance (38.2% retracement of 1.4791 to 1.3538 at 1.4017) holds. Next target is 61.8% retracement of 1.2005 (2021 low) to 1.4791 at 1.3069.

In the long term picture, as long as 55 M EMA (now at 1.3514) holds, up trend from 0.9056 (2007 low) should still resume through 1.4791 at a later stage. However, sustained trading below 55 M EMA will argue that the up trend has already completed, with rise from 1.2005 to 1.4791 as the fifth wave. 1.4791 would then be seen as a long term top and deeper medium term down trend should then follow.

[ad_2]

Source link