[ad_1]

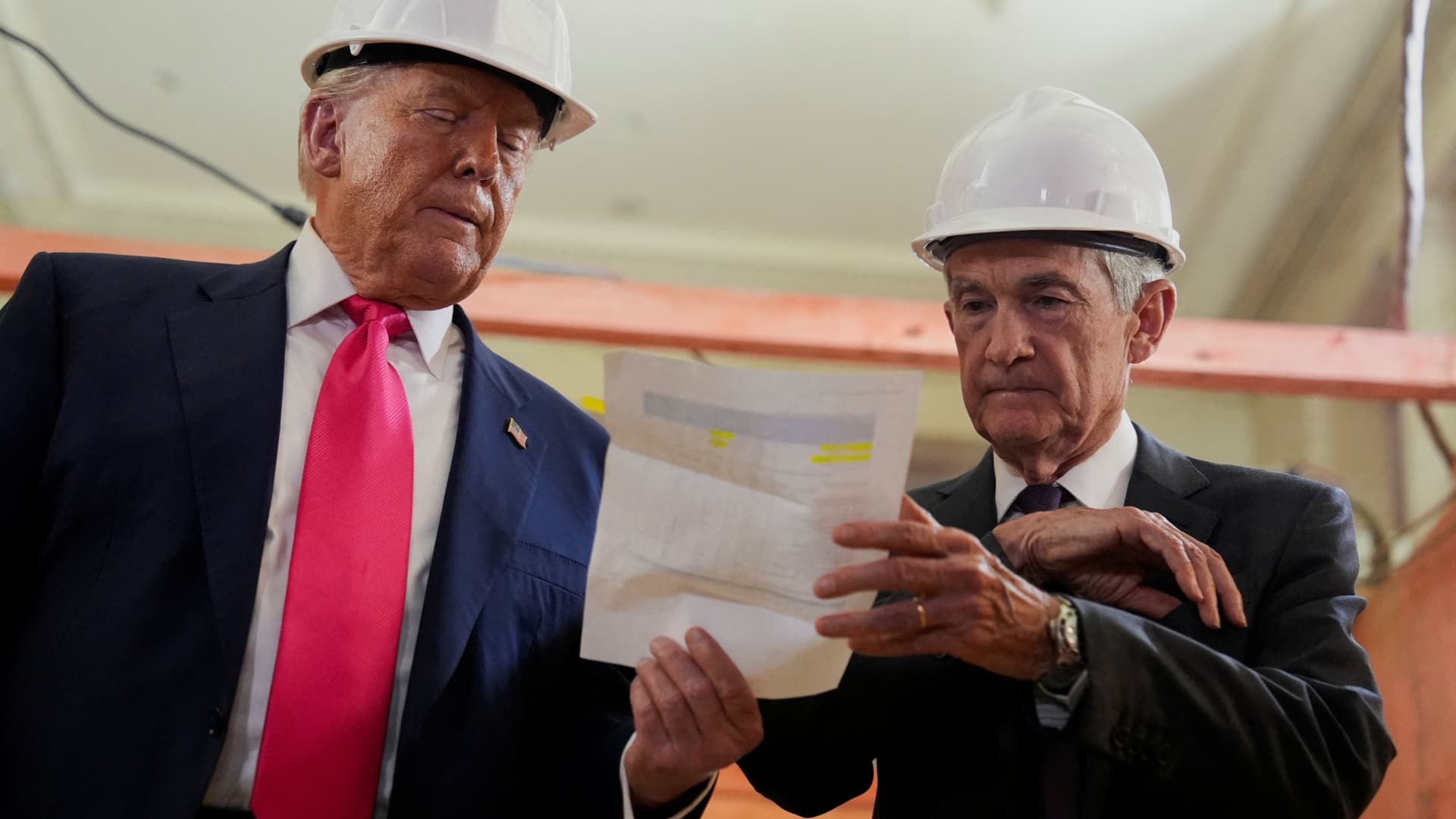

Scott Olson | Getty Images

Macy’s posted second-quarter earnings Wednesday that easily topped Wall Street’s expectations, as it said revamped stores helped sales trends.

The department store operator also raised its full-year earnings and sales guidance. It now expects adjusted earnings of between $1.70 and $2.05 per share, compared with $1.60 to $2 per share, and revenue between $21.15 billion and $21.45 billion, compared with $21 billion to $21.4 billion.

Macy’s had slashed its full-year guidance last quarter and reported uncertainty in sales due to President Donald Trump‘s tariffs.

“We’re just well-positioned right now for the environment we’re in to take share, to deliver for our customers and to provide a better experience,” CEO Tony Spring told CNBC in an interview.

Here’s how the company performed during its second fiscal quarter, compared with what Wall Street was anticipating, based on a survey of analysts by LSEG:

- Earnings per share: 41 cents adjusted vs. 18 cents expected

- Revenue: $4.81 billion vs. $4.76 billion expected

In the three-month period that ended Aug. 2, the company’s net income was $87 million, or 31 cents per share, compared with $150 million, or 53 cents per share, the year prior. Net sales dropped from $4.94 billion in the year-ago period to $4.81 billion. Adjusted earnings per share were 41 cents.

[ad_2]

Source link