[ad_1]

Precious metals have returned to active growth, pushing the spot price of gold to $3,490—just $10 below its historic high of 22 April. Meanwhile, silver has decisively moved above $40, its highest level in 14 years.

The news agenda continues to favour metals, with reports that India is now actively selling US government bonds, building up its gold reserves. China did the same before, and Russia even earlier. However, this may turn out to be nothing more than a glimpse into the past, cleverly picked up by the global media. It should also be remembered that years of net sales of gold reserves did not initially prevent gold from rallying. This could also work in the opposite direction: the actions of finance ministers and central banks may not have a very noticeable long-term effect.

The lack of progress on a peaceful settlement between Russia and Ukraine also helps gold. After months of virtually empty promises, hopes are gradually fading.

A more visible but at the same time short-term factor is the growing expectation of a Fed key rate cut in September from 75% on 21 August (before Powell’s speech) to 87% now. This leaves room for the rate to rise by another 10-13 percentage points, which is negative for the dollar and positive for commodities.

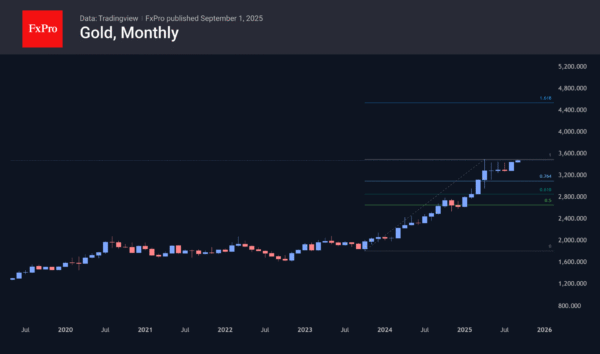

However, we recommend paying more attention to the technical picture now. The gold market has been in a prolonged sideways trend since reaching highs in April. At the same time, the bullish scenario is supported by sluggish resistance from bears in recent days and a series of higher local lows.

Silver has been under less pressure from local profit-taking, gaining in each of the last four months. Platinum and palladium seem to be ending their corrective decline, having risen sharply in early September. This behaviour of precious metals indicates that traders are serious about this direction, sharply increasing the chances of new historical highs soon.

Nevertheless, we urge caution when joining the gold rally in the coming days. First, reaching historic highs could trigger widespread selling in gold, as we saw in April and as is happening with Bitcoin.

If the breakout above $3,500 does not trigger a sell-off, as was the case earlier this year, the potential target is $4,500, close to which the 161.8% Fibonacci extension level is located.

In silver, it appears that the bulls are targeting the area of historical highs near $50.

Platinum also looks rested and ready to renew its multi-year highs after a corrective pullback. Its technical growth potential suggests a rise above $1,800, to the highs of 2011. However, such ambitious growth will only become the main scenario if the recent highs are exceeded and the price rises above $1,500.

[ad_2]

Source link