[ad_1]

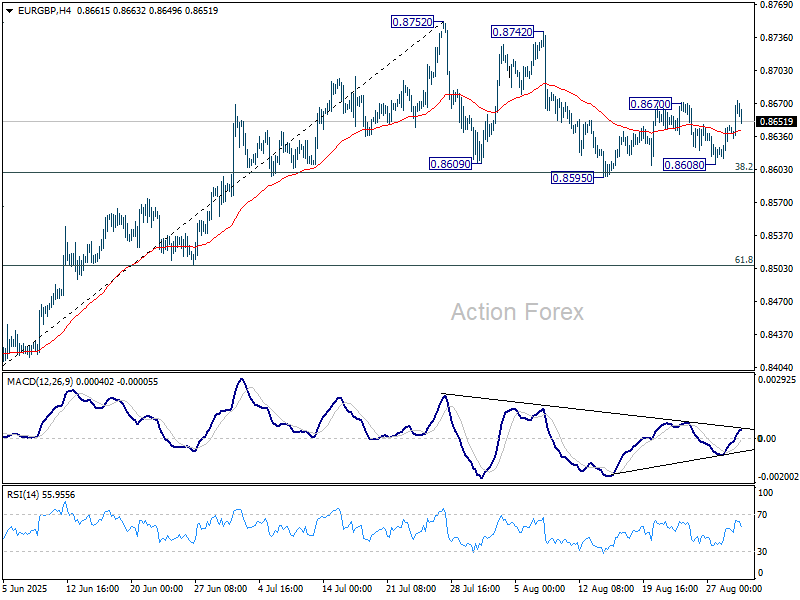

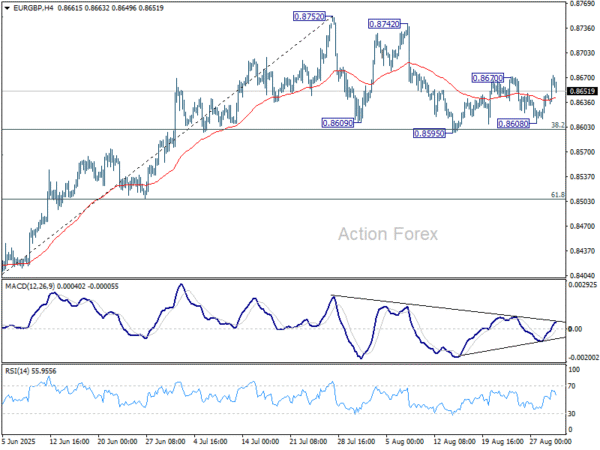

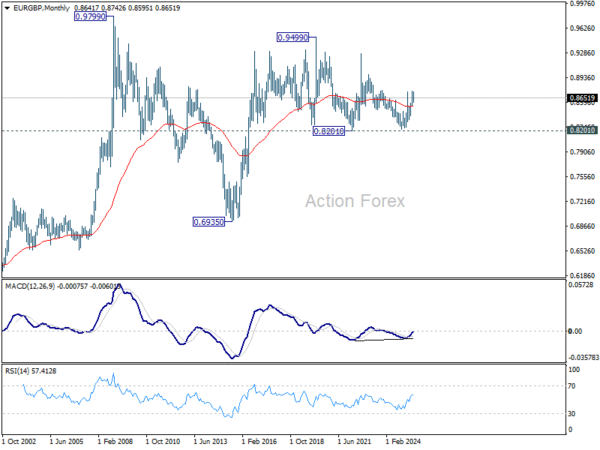

EUR/GBP gyrated in range above 0.8595 last week and initial bias stays neutral this week first. On the upside, firm break of 0.8670 resistance will retain near term bullishness and extend the rebound from 0.8595 to retest 0.8752 high. However, sustained trading below 38.2% retracement of 0.8354 to 0.8752 at 0.8600 will indicate near term bearish reversal and target 61.8% retracement at 0.8506.

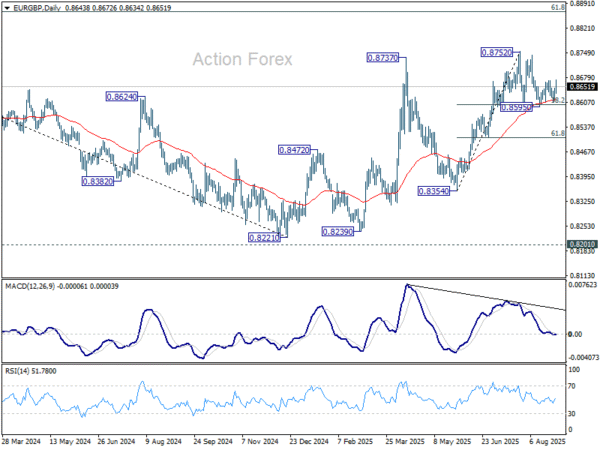

In the bigger picture, the structure from 0.8221 medium term bottom are not impulsive enough to suggest that it’s reversing the down trend from 0.9267 (2022 high). But even if it’s a correction, further rise could still be seen to 61.8% retracement of 0.9267 to 0.8221 at 0.8867. Nevertheless, sustained trading below 55 W EMA (now at 0.8502) will argue that the pattern has completed and bring retest of 0.8221 low.

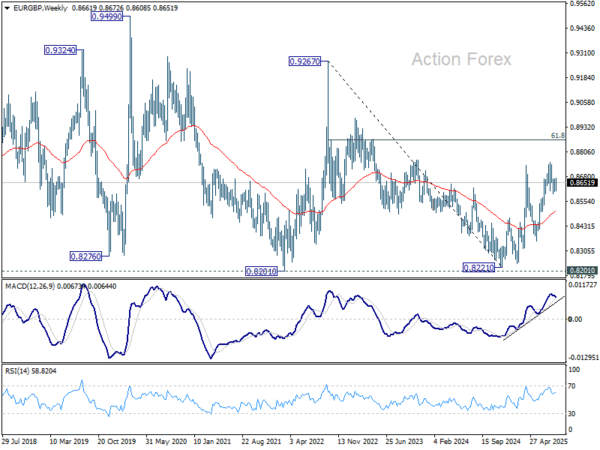

In the long term picture, price action from 0.9499 (2020 high) is seen as part of the long term range pattern from 0.9799 (2008 high). Range trading should continue between 0.8201 and 0.9499, until there is clear signal of imminent breakout.

[ad_2]

Source link