The IPO will be entirely an offer for sale (OFS) of up to 43.75 million equity shares, according to the draft red herring prospectus. Embassy Buildcon LLP, the promoter, plans to offload up to 33.46 million shares, while investor 1 Ariel Way Tenant will sell up to 10.29 million shares.

JM Financial, ICICI Securities, Jefferies India, Kotak Mahindra Capital, and 360 ONE WAM are the book-running lead managers.

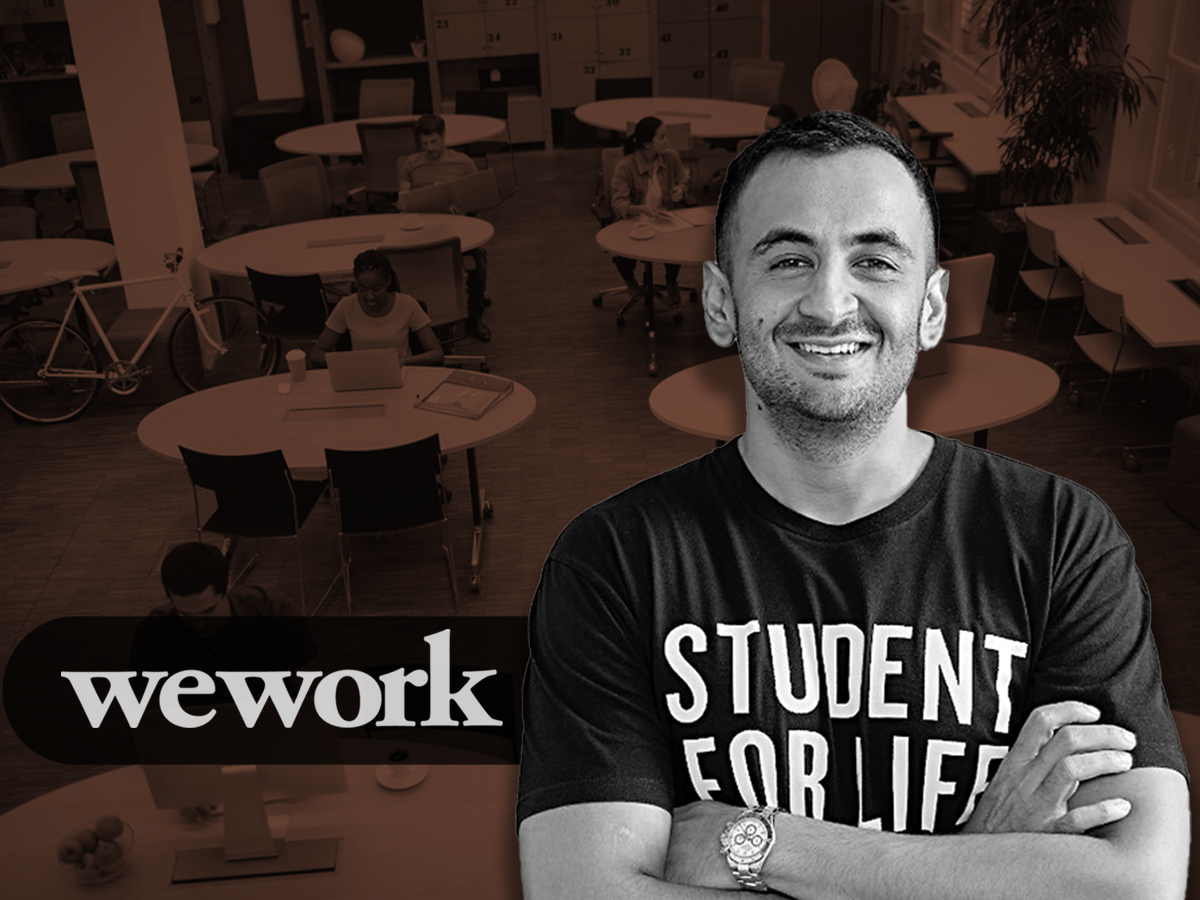

WeWork India’s public offer was brought out of abeyance by the markets regulator last week. The company is looking to raise Rs 4,000 crore through via listing, ET reported last week. Since the IPO is entirely an offer for sale, the proceeds will go to the selling shareholders.

WeWork India, backed by Bengaluru-based real estate major Embassy Group, holds the exclusive licence for the WeWork brand in India since 2017. It operates 94,440 desks across 59 centres spanning 6.48 million square feet as of September 30, 2024. Its portfolio is heavily concentrated in Grade A properties (about 93%), with centres in major cities including Bengaluru, Mumbai, Pune, Hyderabad, Gurgaon, Noida, Delhi, and Chennai.

WeWork’s plan to sell its 27% stake in the Indian unit and exit the country collapsed in September 2024 due to a valuation mismatch, even after the deal was cleared by regulators, as ET reported. The remaining 73% is held by Embassy Group, which will be selling a portion of its stake in IPO.

With a management overhaul at WeWork US, a change in strategy for the India market was expected.

Softbank-backed WeWork Inc. was cofounded by Adam Neumann and Miguel McKelvey in 2010 in New York. The company filed for Chapter 11 bankruptcy in the US in November 2023 and appointed John Santora as chief executive in June. Back then, WeWork India had assured that troubles at the global entity will not hamper its operations.