Also in the letter:

■ China rains on India’s smartphone parade

■ Raveendran en garde

■ Layoff wave reaches Amazon

Udaan acquires retail tech startup ShopKirana for $88.5 million in stock

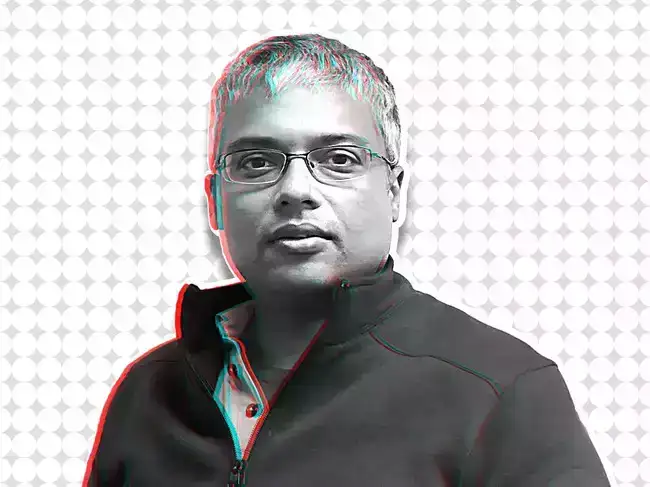

Vaibhav Gupta, CEO, Udaan

B2B ecommerce major Udaan has snapped up ShopKirana in an all-stock deal valuing the Indore-based startup at $88.5 million. The acquisition comes just weeks after Udaan raised $114 million from Lightspeed and M&G Investments. The move will also see Udaan roping in InfoEdge Ventures as a shareholder.

Deal math:

- InfoEdge’s 26.14% in ShopKirana translates to a 1.48% holding in Udaan, now worth $23.1 million.

- Founders and early backers will own a combined 5–6% in Udaan.

- ShopKirana’s FY25 revenue dropped 27% year-on-year to Rs 471 crore.

The strategy:

- Udaan wants to scale staples, fast-moving consumer goods (FMCG), and hotel, restaurants, and catering (HoReCa) categories.

- The ShopKirana deal adds deep kirana ties across tier II/III cities such as Indore, Bhopal, Lucknow, Agra, a growing staples private label (Kisan Kirana), and sourcing muscle.

Zoom out: B2B consolidation is heating up. Jumbotail recently bought Solv. Udaan, eyeing an IPO, has trimmed fixed costs by 20% and cut Ebitda burn by half this year.

What’s next: The focus now shifts to integrating tech, logistics, and credit infrastructure to widen margins in high-frequency categories and push supply chain control beyond metros.

Exclusive: Paytm Money set to get a new chief executive officer

Sandiip Bharadwaj

Sandiip Bharadwaj, former COO at HDFC Securities, is poised to take over as CEO of Paytm Money, replacing Rakesh Singh, who sources told us, will transition into another role within the group.

Who is he: At HDFC Securities, Bharadwaj led the discount broking unit, HDFC Sky. He previously held senior positions at IIFL Securities and Angel One.

The context: Launched in 2017 as a direct mutual fund platform, Paytm Money now offers stock trading, exchange traded funds (ETFs), pension products, and most recently, margin trade funding (MTF).

By the numbers:

- FY24 revenue: Rs 195.7 crore

- Net profit: Rs 71 crore (second straight year in the black)

- FY25 revenue run rate: Close to Rs 200–300 crore

- Active traders (June-end): 7.2 lakh+

Also Read: Paytm Q4 revenue drops 16%, losses persist: Key takeaways

Why this matters: As one of the few profitable units within One97, Paytm Money lags behind much larger peers like IPO-bound Groww, Zerodha, Dhan, and Angel One. This is the second leadership change at the firm in a year, bringing focus on overall Paytm’s leadership stability and capital efficiency.

Sponsor ETtech Top 5 & Morning Dispatch!

Why it matters: ETtech Top 5 and Morning Dispatch are must-reads for India’s tech and business leaders, including startup founders, investors, policymakers, industry insiders and employees.

The opportunity:

- Reach a highly engaged audience of decision-makers.

- Boost your brand’s visibility among the tech-savvy community.

- Custom sponsorship options to align with your brand’s goals.

What’s next: Interested? Reach out to us at spotlightpartner@timesinternet.in to explore sponsorship opportunities.

China’s stealth curbs could derail India’s $32 billion smartphone exports

India’s booming smartphone exports could face turbulence, with the electronics lobby group India Cellular and Electronics Association (ICEA) warning that China’s informal restrictions are disrupting the supply of critical components.

What’s at stake:

- FY25 smartphone exports: $24.1 billion

- FY26 target: $32 billion

- India now produces nearly 20% of the world’s iPhones

Also Read: Apple harvests record iPhone output from its India orchard

What’s changing: China hasn’t issued formal bans, but it’s quietly slowing down shipments of capital equipment, limiting access to rare minerals, and pulling out trained Chinese workers from Indian factories.

Who’s affected: ICEA counts Apple, Foxconn, Tata Electronics, Lava, and Dixon among its members. Many are now struggling to import tools, secure skilled labour, or source materials vital for production.

Looking ahead: India aims to hit $145–155 billion in electronics sub-assembly output by 2030. To stay on course, the government may need to fast-track a resilient local supply chain and reduce dependence on its biggest competitor.

Byju Raveendran pushes back on claims of secret government deals

Byju’s eponymous founder, Byju Raveendran, has hit back at allegations that he’s quietly negotiating payments to Indian officials to settle foreign exchange management law (Fema) violations.

The claim, made in a Delaware court by US lender representative Glas Trust, suggests that behind-the-scenes deals are underway.

Raveendran’s response: He dismissed the charge on X, calling it “pure fiction.” He added that the case involves Think & Learn Pvt Ltd, now under Glas’s control, and that he has no incentive to get involved.

Backdrop: This comes as Raveendran faces civil contempt charges for defying court orders in a loan default case. Glas alleges $533 million was siphoned off from a US-based financing entity.

What’s being contested: The founders insist no funds are missing and have sought stays in Indian courts against the Committee of Creditors’ actions and the Glas-appointed resolution professional.

Why it matters: Tensions are rising, with the founders now threatening a $2.5 billion defamation lawsuit against Glas and its lenders over the reputational fallout.

Amazon trims AWS staff amid internal AI shake-up

Amazon has cut several hundred roles across AWS, its most profitable unit, in a fresh wave of AI-driven restructuring.

Who’s impacted: Among those affected were teams in the “specialists” division, which worked closely with clients to build custom solutions. Staff were informed over email, and system access was revoked soon after.

Company line: “These decisions are necessary as we continue to invest, hire, and optimise resources,” an Amazon spokesperson said.

Big picture: CEO Andy Jassy has warned that AI will increasingly automate corporate workflows, reducing the need for middle managers and some customer-facing roles.

Financial snapshot: AWS continues to deliver strong numbers:

- Q1 revenue: $29.3 billion (up 17% YoY)

- Operating income: $11.5 billion (up 23%)

Context: This follows recent cuts across Amazon’s books, devices, Wondery, and retail units. The focus has now shifted to tightening operations even in high-margin businesses.

Also Read: Tech layoffs: Amazon, Intel to cut more jobs amid AI push, cost control