The bank has reduced its MCLR rates across all tenors effective July 2025:

For the overnight and one-month tenors, the MCLR has been reduced from 8.20% to 7.95%, down by 25 bps. The three-month MCLR is reduced from 8.55% to 8.35%, down 20 bps and the six-month MCLR has been lowered by 20 bps from 8.90% to 8.70%. For the one-year tenor, the MCLR has been reduced from 9.00% to 8.80%, down by 20 bps. The two-year MCLR has been revised from 9.05% to 8.85%. And for the three-year tenor, it has been reduced by 20 bps from 9.10% to 8.90%.

Also read: SBI revises FD interest rate on these fixed deposits: Check latest SBI FD interest rate

| Tenor | Existing MCLR (In %) | Revised MCLR (In %) |

| Over night | 8.2 | 7.95 |

| One Month | 8.2 | 7.95 |

| Three Month | 8.55 | 8.35 |

| Six Month | 8.9 | 8.7 |

| One Year | 9 | 8.8 |

| Two Years | 9.05 | 8.85 |

| Three Years | 9.1 | 8.9 |

Other SBI lending rates

SBI EBLR and RLLR

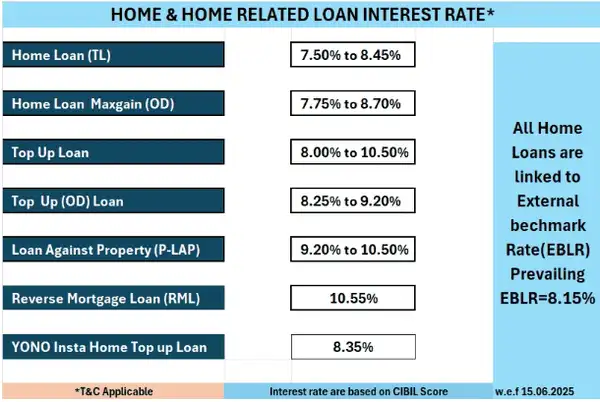

The bank is offering an External Benchmark Lending Rate (EBLR) of 8.15% + Credit Risk Premium (CRP) + Business Strategy Premium (BSP) effective June 15, 2025.

Similarly, the Repo Linked Lending Rate (RLLR) is 7.75% + CRP, effective June 15, 2025

These rate cuts could lead to lower interest rates on loans linked to EBLR and RLLR, depending on the reset date of the borrower.

SBI External Benchmark Rate (EBR)

With effect from June 15, 2025, the External Benchmark Rate (EBR) is 8.15%. The EBR is the rate on the basis of which banks determine the interest rates for various floating rate loans, including home loans and MSME loans, as mandated by the Reserve Bank of India (RBI).SBI home loan interest rate varies from 7.50% to 8.45% based on the CIBIL score of the borrower. SBI Home loan Maxgain OD interest rate varies between 7.75% and 8.70%. For a top up home loan, the interest rate varies between 8% and 10.50%. These rates are effective from June 15, 2025.

What is CIBIL Score

The Credit Information Bureau (India) Limited (CIBIL) is the most popular of the four credit information companies licensed by the Reserve Bank of India. There are three other companies also licensed by the RBI to function as credit information companies. They are Experian, Equifax and Highmark.

What is the processing fee for SBI Home loans

SBI charges a processing fee of 0.35% of the home loan amount (plus applicable GST), subject to a minimum of Rs 2,000 and a maximum of Rs 10,000 (both excluding GST).