The Noida-based merchant payment processor is backed by some of the biggest names in global fintech investing.

Peak XV Partners (formerly Sequoia India), Temasek’s Macritchie Investments, PayPal, Mastercard, Invesco, Actis, and Madison India are among investors looking to partially exit through the OFS. Cofounder Lokvir Kapoor is also offloading a portion of his stake.

ET had reported on June 11 that Pine Labs was preparing to file its DRHP by this month-end. Founded in 1998, the company filed the papers close on the heels of Groww, another wealthtech startup, which filed for IPO through the confidential route on May 24.

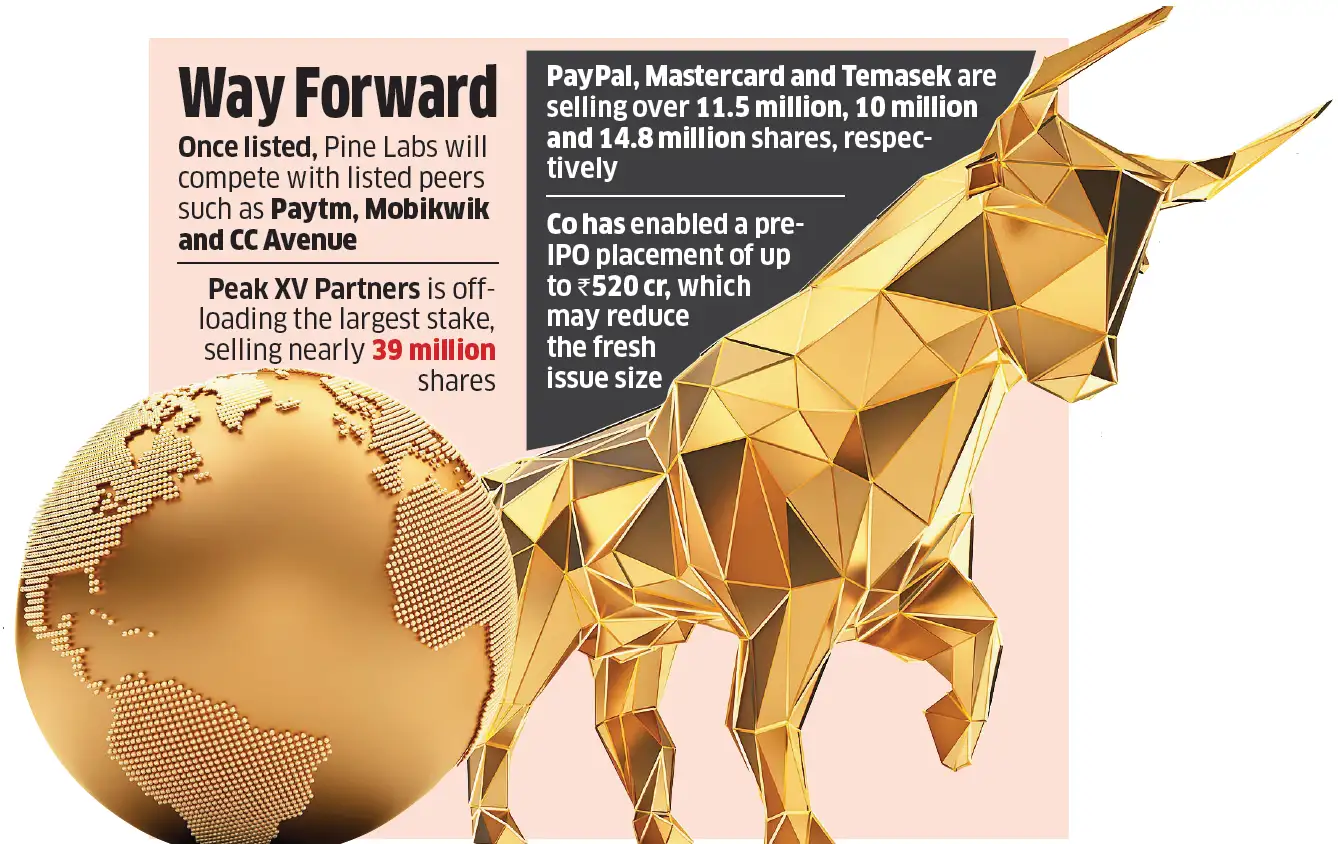

Once listed, Pine Labs will compete with fellow publicly-traded payment firms like Paytm, Mobikwik and CC Avenue.

Peak XV, which owns around 20% in the company, will sell the largest chunk, at nearly 39 million shares. PayPal is selling over 11.5 million shares, while Mastercard and Temasek are trimming about 10 million and 14.8 million shares, respectively. Mastercard, Actis, PayPal and Temasek are significant shareholders in the firm — each with more than 5% stake.

ETtech

ETtechPine Labs has also enabled a pre-IPO placement of up to Rs 520 crore, which, if executed, will reduce the fresh issue size, the company said in the draft papers.

The company recently merged its Singapore entity into the Indian arm ahead of the IPO.

Axis Bank, Morgan Stanley, Citi, JP Morgan, and Jefferies are the lead managers to the issue.

The company plans to use the IPO proceeds to repay debt partially or fully, invest in its operations in Southeast Asia and West Asia, and in technology and acquisitions.

Pine Labs will spend around Rs 60 crore in international expansion, investing primarily in hiring senior talent and strengthening the technology stack as per regulatory requirements.

Pine Labs closed the first nine months of FY25 with a 23% on-year rise in operating revenue at Rs 1,208 crore. The company turned profitable in FY25 with a net profit of Rs 26 crore till December FY25, compared to a net loss of Rs 151 crore a year back. Revenues also grew while it controlled expenses. Total expenses grew marginally to Rs 1,238 crore till December 2025 from Rs 1,205 crore a year back.

Pine Labs serves 915,731 merchants, 666 consumer brands and enterprises, and 164 financial institutions across India and overseas.

As of December 2024, the company said it processed around Rs 7.5 lakh crore worth of transactions, up 68% from Rs 4.4 lakh crore settled till December 2023. Pine Labs acquires merchants for large lenders like HDFC Bank, works closely to offer payments and commerce solutions to large consumer brands like Croma, besides powering merchants looking to sell via both online and offline channels.