Also in the letter:

■ Qcomm fails to deliver

■ Stargate’s teething problems

■ Small towns, big compute

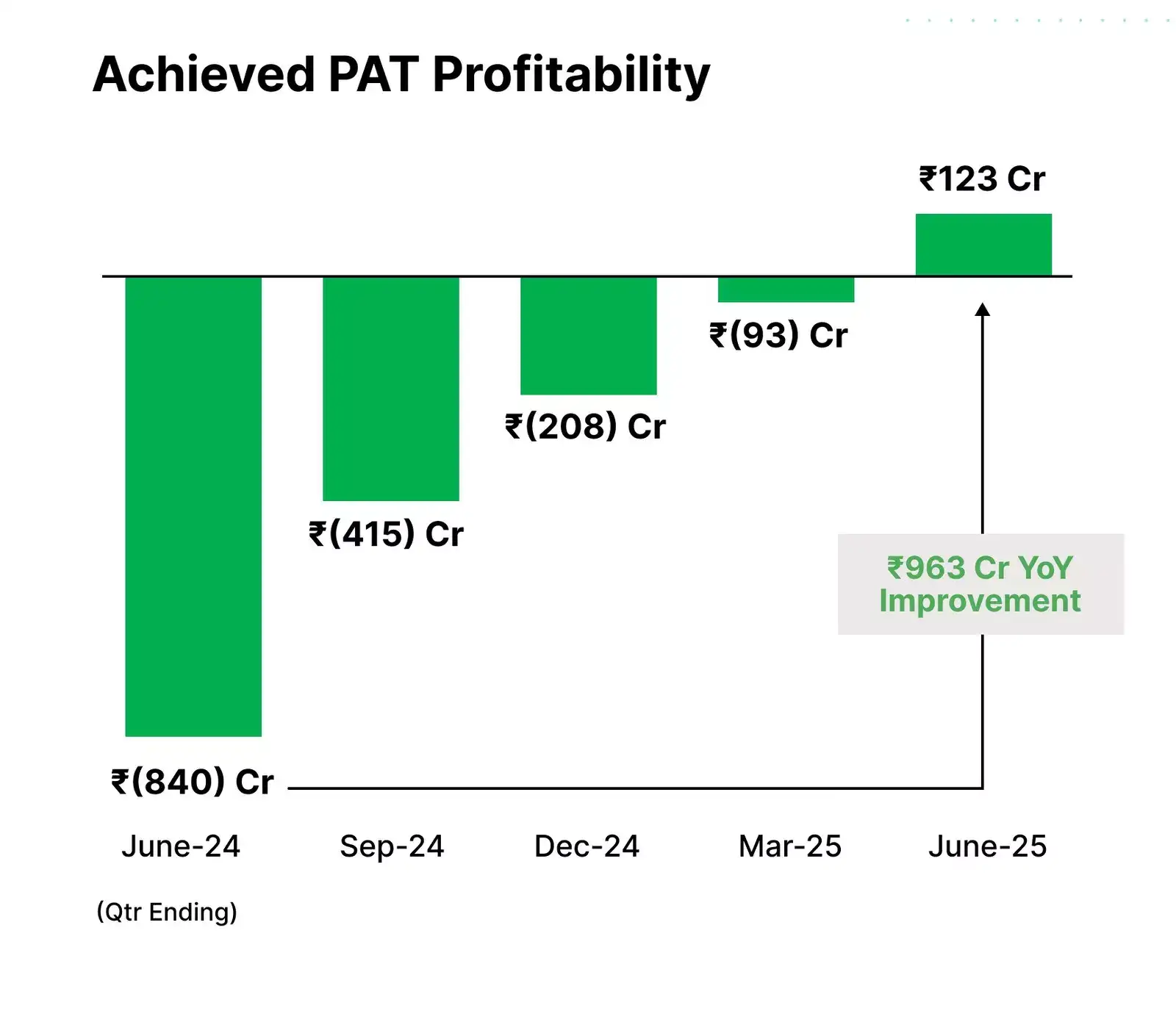

Paytm swings to first-ever profit in Q1 FY26

Paytm founder Vijay Shekhar Sharma

Paytm has turned in its first-ever quarterly profit, marking a milestone for its parent, One97 Communications. The company posted a net profit of Rs 122 crore in Q1 FY26, a sharp turnaround from a loss of Rs 839 crore a year ago, and Rs 540 crore in Q4 FY25. This shift followed strong revenue growth and tighter control over costs.

By the numbers:

- Operating revenue: rose 28% YoY to Rs 1,917 crore

- Contribution profit: jumped 52% YoY to Rs 1,151 crore, with 60% margin (up 10 percentage points)

- Ebitda: came in at Rs 72 crore (4% margin); PAT at Rs 123 crore

- Cash reserves: remain healthy at Rs 12,872 crore

Source: Paytm

Driving the news: Growth was driven by a surge in merchant subscriptions, better payment margins, and a doubling of revenue from financial services.

- Marketing spends remained under Rs 100 crore.

- Employee costs decreased 32% year-over-year to Rs 643 crore, reflecting a leaner and more disciplined quarter.

Boardroom changes:

- Group chief financial officer Madhur Deora will retire by rotation as an executive director on Paytm’s board.

- Independent director Bimal Julka has resigned to explore his “areas of emerging technologies and ease of doing business.”

- Urvashi Sahai has been appointed as an additional director for a five-year term.

Eternal crosses Rs 3 lakh crore in market cap, beats Wipro, Tata Motors

Eternal CEO Deepinder Goyal

Shares of Eternal, the parent company of Zomato and Blinkit, reached a record high of Rs 311.60 on Tuesday, with its market capitalisation briefly surpassing the Rs 3 lakh crore mark. That surge places it ahead of blue-chip firms like Wipro, Tata Motors, JSW Steel, and Nestlé India on the Nifty 50.

Driving the rally:

- Blinkit’s Q1 numbers stood out, with gross order value rising 140% year-on-year.

- Contribution margins improved by 50 basis points quarter-over-quarter, fueling optimism.

- Jefferies upgraded the stock to ‘Buy’, setting a Street-high target of Rs 400

- JM Financial and Emkay also revised their targets upwards, citing solid execution and a more confident tone from the leadership.

What’s changing: Eternal is shifting Blinkit towards an inventory-led model. Analysts believe this could improve margins by 100 basis points, though it will require more working capital and tighter supply chain management.

Also Read: Blinkit won’t cede quick commerce market leadership, says Albinder Dhindsa

Yes, but: Macquarie remains cautious. It flagged Eternal’s valuation, arguing that the current price implies a $15 billion valuation for Blinkit—without a proven path to sustainable profitability. The brokerage maintained its ‘Underperform’ call with a target price of Rs 150.

Why it matters: The surge indicates increasing investor confidence in quick commerce, supported by better economics and a more explicit strategic focus.

Also Read: No obvious threat, says Eternal CEO Goyal on new entrants in food delivery space

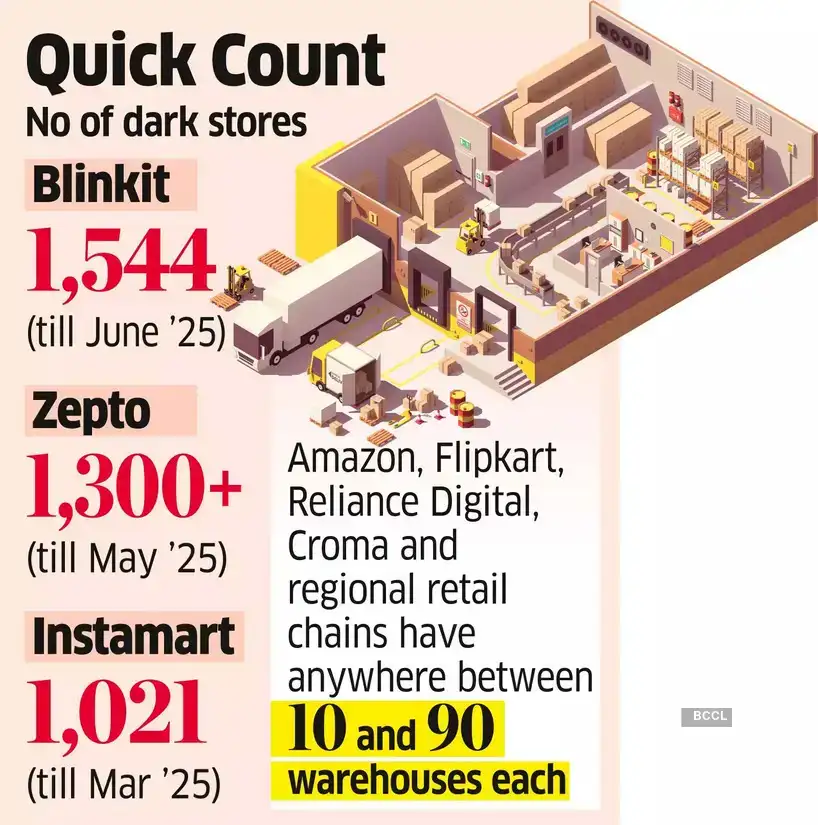

Quick commerce promised scale to electronics firms—then broke their supply chains

When brands like Boult Audio and Havells embraced quick commerce, they expected a surge in sales. What they got instead were headaches in forecasting, inventory management and fulfilment.

What happened:

- Initially, platforms like Blinkit and Zepto delivered sharp spikes in small electronics sales.

- But brands struggled to keep pace. Hyperlocal inventory, real-time replenishment and demand forecasting at city-pin levels exposed deep cracks in their supply chain.

- As Boult’s Varun Gupta put it: “Q-commerce doesn’t break your sales funnel—it breaks your backend”

The format challenge: Dark stores prioritise fast-moving essentials over bulky items. That’s not exactly great news for appliances like air conditioners or microwaves, where variety, installation and fulfilment are non-negotiable. Havells’ Lloyd, for instance, couldn’t crack AC sales on Blinkit due to limited options and poor logistical fit.

Big picture: The opportunity, however, is real. Quick commerce is now a high-growth channel for sub-Rs 3,000 gadgets—think wearables, hair dryers and trimmers. To tap into it meaningfully, brands are learning to operate like FMCG firms, with daily stock refreshes, geo-level forecasting, and deep integration with dark stores.

Also Read: ETtech In-depth: Quick commerce is diversifying fast. It won’t be easy

Why it matters: Q-commerce is emerging as the fastest-growing channel for small electronics. However, without operational vigilance and technical accuracy, brands risk overloading their backends in pursuit of short-term spikes.

Also Read: Brands look to quick commerce for fast growth, but costs remain a concern

OpenAI, SoftBank scale back Stargate AI megaproject

Sam Altman and SoftBank CEO Masayoshi Son

Six months ago, SoftBank’s Masayoshi Son and OpenAI’s Sam Altman unveiled Project Stargate at a White House event with all the trappings of a moonshot. The pitch? A $500 billion artificial intelligence data centre network, backed by OpenAI, SoftBank, and Oracle, marking the Trump administration’s grand AI entrance.

Driving the news: Now the scale tells a different story. Stargate is being sharply downsized. The first phase is set to deliver a much smaller facility—likely in Ohio—by the end of the year, according to the Wall Street Journal. As the fanfare ends, the slog begins.

What changed:

- Tensions flared between OpenAI and SoftBank over location and governance.

- Shifting US energy priorities under President Trump have disrupted the infrastructure roadmap.

- The original vision promised a sweeping AI superstructure with 100,000 new jobs and national-scale compute power.

However: OpenAI announced on Tuesday that it is partnering with Oracle to develop 4.5 gigawatts (GWs) of additional Stargate data centre capacity in the US.

- In a blog post, the company stated that this partnership was in addition to the 5 GW+ Stargate AI data centre capacity under development, which will operate over 2 million chips.

Altman also confirmed the development on X, stating that it was “easy to throw around numbers” and that this “is a gigantic infrastructure project.”

Tier-II cities emerge as India’s next data centre hotspots

India’s AI surge is redrawing the data centre map. As metros run out of space and costs spike, cities like Nagpur, Lucknow, Kochi, and Jaipur are stepping into the spotlight with cheaper land and generous state incentives.

What’s happening:

- CtrlS, Sify, RackBank, and ESDS are moving beyond Mumbai and Chennai

- Chhattisgarh is offering subsidies of up to Rs 300 crore and salary reimbursements

- Rajasthan wants to attract Rs 20,000 crore via its data centre policy

- Gujarat and Uttar Pradesh are throwing in capital support and tax breaks

What’s new: Modular and edge data centres emerging as the next frontier. These compact setups bring AI computing closer to users in sectors such as healthcare, agriculture, surveillance, and manufacturing.

IDC insight: Investments in edge public cloud models across APAC (excluding Japan) are projected to grow at a 17% CAGR from $15 billion in 2024. India’s curve is rising fast.