The move, if implemented, will allow firms such as Magicpin, Paytm, Ola Consumer and Waayu to use the incentives to offer discounts to customers.

“The modalities of the scheme are being worked out and the final amount could change. ONDC officials and representatives from restaurants and food delivery firms have been in conversations for the last month on the issue,” said one of the persons, who did not wish to be identified, adding that subsidies of Rs 100-150 crore could result in 80-100 million orders going to restaurants via ONDC. These incentives are expected to be rolled out over a period of time, the person said.

India’s food delivery market is largely controlled by Eternal-owned Zomato and Bengaluru-based Swiggy, prompting restaurants forced to pay high commission fees to seek alternatives. In January, after both platforms launched 10-minute delivery services that could compete directly with eateries, the National Restaurant Association of India (NRAI) asked its members to join the ONDC.

Also Read: NRAI, ONDC say working together more strategically than ever

While the entry of the ONDC in the food delivery segment in 2021 was meant to challenge the dominance of the larger players, it did not yield the desired results, according to analysts.

“High commission fee of 18-25% per order (by Zomato and Swiggy) is driving restaurants to alternatives like ONDC, which charges 10-11% commissions and offers direct customer data access,” brokerage firm BNP Paribas said in a recent note, adding that while restaurants tried to leverage the ONDC platform, it has “not seen any meaningful success”.

The brokerage has projected that India’s food delivery market – which is a cash cow for Zomato and Swiggy – will expand to $17-21 billion by 2028 from $8 billion in 2023.

To explore alternatives, restaurants have also started working with urban mobility platform Rapido as it gears up to launch a low-commission food delivery offering, Ownly, ET had reported earlier.

For two consecutive quarters of October-December 2024 and January-March 2025, food delivery growth for both Zomato and Swiggy was below 20%. In the April-June quarter, growth is likely to have fallen further to 15-16%, sector analysts have estimated.

Also Read: How Swiggy and Zomato are dealing with the slowdown in food delivery

Responding to queries by ET, an ONDC spokesperson said, “ONDC is working in close collaboration with NRAI under the guidance of DPIIT, Ministry of Commerce & Industry, to enable India’s restaurant and food delivery ecosystem to serve customers more efficiently, transparently, and on their own terms.”

ONDC state of play

The move to bring back incentives on the network has also come close on the heels of leadership changes at the ONDC. Its chief executive Thampy Koshy resigned from his position in April, after which chief operating officer Vibhor Jain was named the acting CEO.

In June, independent director Arvind Gupta stepped down from his post, and his departure was preceded by that of non-executive chairperson RS Sharma and chief business officer Shireesh Joshi. ONDC is governed by a board of directors and an advisory council. The board includes founding members, shareholders, government nominees and independent directors.

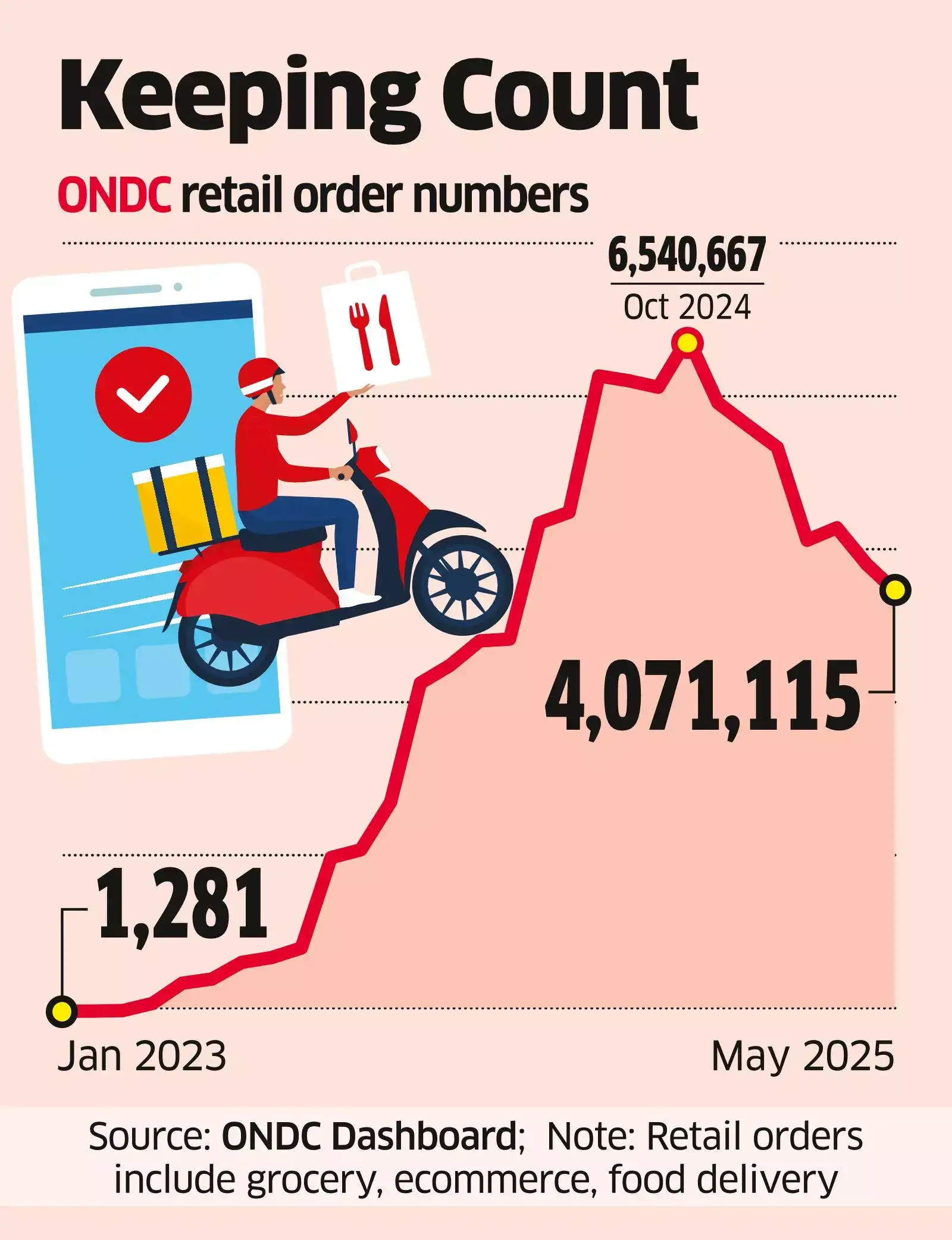

In March, ET had reported that pulling back of the subsidies had led to a fall in overall retail orders on the network. Retail orders include ecommerce, grocery and food delivery. From a peak of 6.5 million in October last year, retail orders on ONDC fell to 4.6 million in February this year. During May – for which the latest data is available – the network saw retail orders further decline to 4.1 million. ONDC, which started its first pilot rollout in 2022, spend around Rs 95 crore in fiscal 2023 and fiscal 2024 on marketing interventions, or subsidies. At its peak, it was offering up to Rs 3 crore in incentives to each of its network participant monthly, which was gradually reduced to a maximum of Rs 30 lakh over time.

ETtech

ETtech“ONDC’s early incentive programmes were designed as short-term enablers to help stakeholders experiment with and adopt the open network. These were never intended to mirror deep discounting strategies seen elsewhere,” the ONDC spokesperson said.

Analysts also pointed to issues with last-mile logistics as a key reason behind the ONDC’s food delivery not scaling up beyond a point.

“ONDC has not been able to scale up very clearly on the food delivery side because food delivery as a proposition is very time sensitive. So you need to have lead times which are 35-40 minutes or lower than that. The problem with ONDC is that they don’t have last-mile connectivity,” said Karan Taurani, executive vice president, Elara Capital.

He added that the proposed incentives might provide a temporary volume growth by tapping into the price-sensitive customer segment, with those valuing experience over discounts continuing to stick to the incumbents.