Also in the letter:

■ VC funding on the rise

■ Revival by FY26: Angel One CEO

■ Micron’s AI focus

Startups aim for over Rs 18,000 crore in IPO frenzy

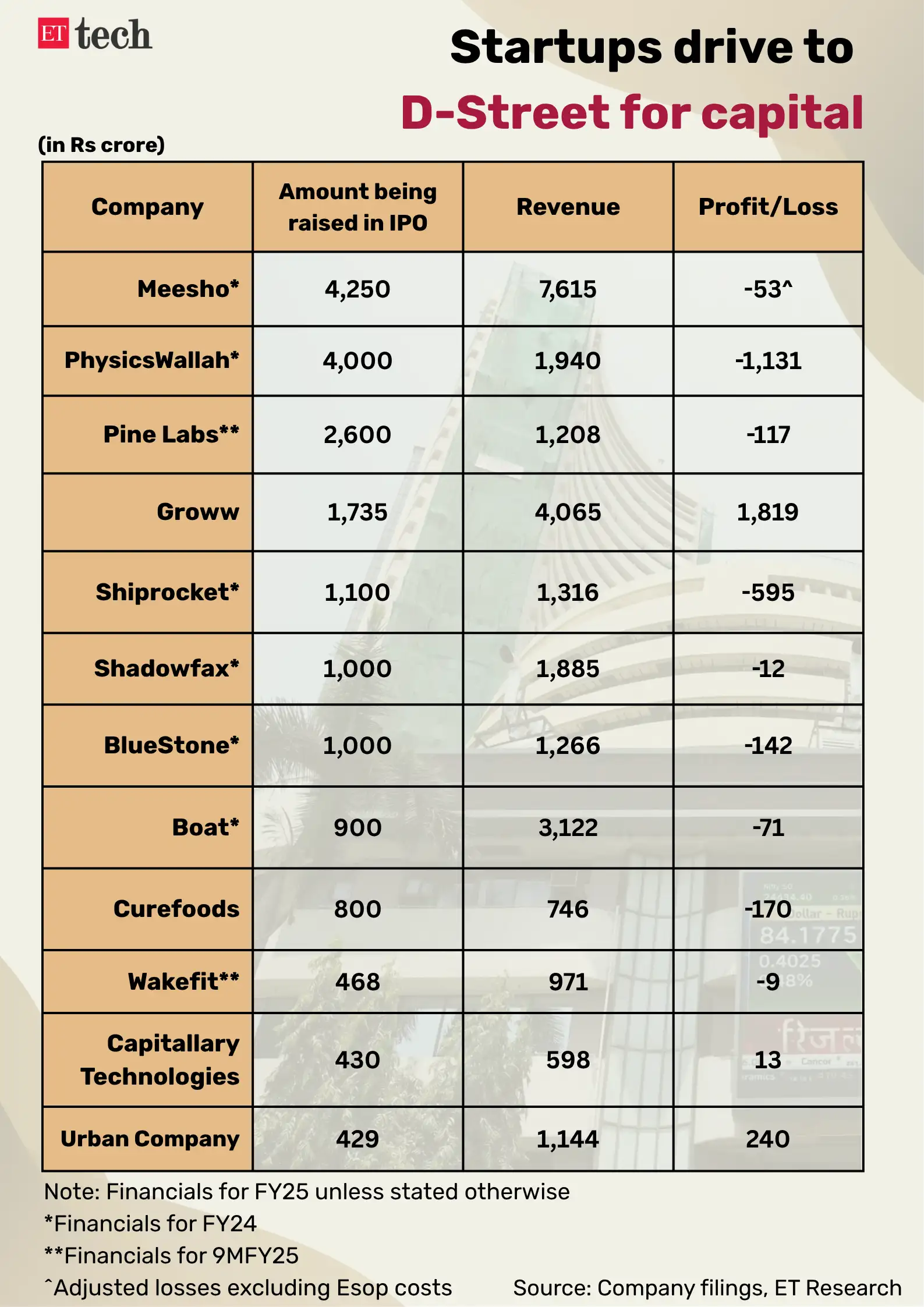

A dozen new-age companies that have filed draft IPO papers are looking to raise over Rs 18,000 crore ($2 billion) through fresh share issues, signalling renewed momentum in India’s public markets.

Leading the pack: Ecommerce platform Meesho, which is set to file confidentially, is eyeing the biggest primary raise at Rs 4,250 crore. Close behind is edtech player PhysicsWallah, aiming for Rs 4,000 crore.

Long queue:

- Pine Labs and Groww are targeting Rs 2,600 crore and Rs 1,735 crore, respectively.

- Others, such as Boat, Wakefit, Capillary Technologies, and Urban Company, are planning smaller issues of under Rs 1,000 crore each.

- These figures exclude any offer-for-sale (OFS) component, which will increase the overall IPO size further.

Rush hour: Analysts and bankers point to strong public market valuations and growing confidence among startups, many of which now see local listings as a viable route.

How it stacks up:

- In 2021-22, startups like Zomato (now Eternal), Paytm, Delhivery, Nykaa, and PB Fintech raised over Rs 25,000 crore in fresh capital. Zomato and Paytm alone brought in Rs 17,000 crore.

- The two years that followed saw a dip, with a string of sub-Rs 1,000 crore issues from the likes of Ixigo, Awfis, Blackbuck, MobiKwik, and Honasa Consumer.

Also Read: IPO watch: Which Indian startups are next to hit the stock market?

Early Nykaa investor to sell stake in block deal

Harindarpal Singh Banga, founder, The Caravel Group

Harindarpal Singh Banga, founder of the Hong Kong-based Caravel Group and an early investor in Nykaa, plans to sell a 2–2.5% stake in the company through a block deal worth $150 million (approximately Rs 1,200–1,300 crore), sources told ET.

Founders stay put: Meanwhile, the Nayar family, which founded Nykaa, still owns 52% and has not sold any shares since the company listed in November 2021.

H-1B hopefuls brace for longer wait times, delays in Trump 2.0

The H-1B application window for this fiscal year has shut. Now begins the long wait—and possibly a tougher ride. Experts are already warning of higher rejection rates, slower processing and more paperwork under a Trump administration that is deeply sceptical of immigration.

Numberwise:

- 85,000 applicants made it through the H-1B lottery this March.

- In 2018, denial rates under the first Trump administration hit 15% overall—24% for new applications and 12% for renewals, according to Pew Research.

- During Biden’s presidency, rejection rates fell sharply, dropping to just 3%, Pew noted.

- Between 2016 and 2020, H-1B processing times increased by 12-36 months, according to data from immigration platform Jeelani Law Firm.

Imminent scrutiny: “We do expect to start seeing increased scrutiny of H-1B petitions eventually. Given what we saw during Trump’s first term in office, and the administration’s general scepticism of the positive impact of immigration, it is important to be prepared for what is very likely coming,” said immigration attorney Joel Yanovich.

Workarounds and detours: Alternatives to the H-1B route are seeing a spike in interest.

- Applications for the EB-5 investor visa have jumped 50% since January.

- There’s also growing demand for L-1 and O-1 visas.

- The EB-2 NIW (National Interest Waiver), which allows highly qualified individuals working in areas of US national interest to stay and work in the country, is another option gaining traction.

Yanovich noted that while this demand usually picks up after the H-1B lottery season, this year’s surge also reflects a broader trend – more applicants are now actively looking to sidestep the scrutiny they anticipate ahead.

Also Read: O-1 for the books! Elite talent finds new route to US

Sponsor ETtech Top 5 & Morning Dispatch!

Why it matters: ETtech Top 5 and Morning Dispatch are must-reads for India’s tech and business leaders, including startup founders, investors, policy makers, industry insiders and employees.

The opportunity:

- Reach a highly engaged audience of decision-makers.

- Boost your brand’s visibility among the tech-savvy community.

- Custom sponsorship options to align with your brand’s goals.

What’s next: Interested? Reach out to us at spotlightpartner@timesinternet.in to explore sponsorship opportunities.

Venture capital funding inches up to $4.9 billion in H1 2025

Venture capital funding in Indian startups showed early signs of a rebound in the first half of 2025, with total deal value rising slightly to $4.95 billion across 410 deals, according to data analytics platform Venture Intelligence.

VC favourites: That’s a modest improvement on the same period last year, when startups raised around $4.54 billion from 418 deals. Ecommerce led the charge this year, pulling in $1.3 billion, followed by fintech with $1 billion. Enterprise software, deep tech, and health tech also attracted strong investor interest.

Big ticket investments:

- Innovaccer: $275 million

- Meesho: $270 million

- Groww: $200 million

- Porter: $200 million

2025 unicorns: India minted five unicorns in the first half of 2025—Netradyne, Porter, Drools, BlueStone, and Jumbotail—compared to only six in the entire previous year.

IPOs in line: The public markets are beginning to beckon again. Several startups have filed their draft red herring prospectuses (DRHPs) this year, lining up for new listings in the coming months. Expect to see Shadowfax, PhysicsWallah, Boat, Urban Company, Shiprocket, Groww, Pine Labs, Capillary Tech, Wakefit, and Curefoods on that list.

Also Read: IPO watch: Which Indian startups are next to hit the stock market?

Other Top Stories By Our Reporters

Ambarish Kenghe, group CEO, Angel One

Expect market to open up by end of FY26: Angel One group CEO Kenghe| Angel One’s new group chief executive officer, Ambarish Kenghe, expects business momentum to pick up by the end of the current financial year as the immediate effects of the regulatory changes on speculative trading and the global macroeconomic challenges settle down.

Micron shifts gears in AI era: Micron Technology is focusing on data centre and artificial intelligence (AI) opportunities in a shift from product-oriented to market segment-oriented business units, said its chief business officer Sumit Sadana.

IEA throws weight behind India’s digital energy stack: The International Energy Agency (IEA) is backing the India Energy Stack, a vital digital public infrastructure aimed at standardising and improving interoperability across the power sector, said the IEA executive director Fatih Birol.

Global Picks We Are Reading

■ A group of young cybercriminals poses the ‘most imminent threat’ of cyberattacks right now (Wired)

■ Taiwan is creating an offshore wind industry to fuel its semiconductor factories (Rest of World)

■ Can the music industry make AI the next Napster? (The Verge)