Missing, delayed contributions

Every month, when a portion of your salary gets diverted towards the EPF account, your employer is expected to deposit an equivalent amount. The employer is obligated to remit this payment within a specified time frame, usually the 15th of the following month. Since it is the employer’s responsibility, most of us trust company officials to make the payin punctually. You may not realise it at the time, but your employer may have missed or delayed some contributions. If the employer has not remitted the PF dues, you may face problems during withdrawal.

Amey Kanekar, Founder, FinRight Technologies, points out “Delayed or missing contributions may ultimately lead to your claim getting rejected or put on hold.”

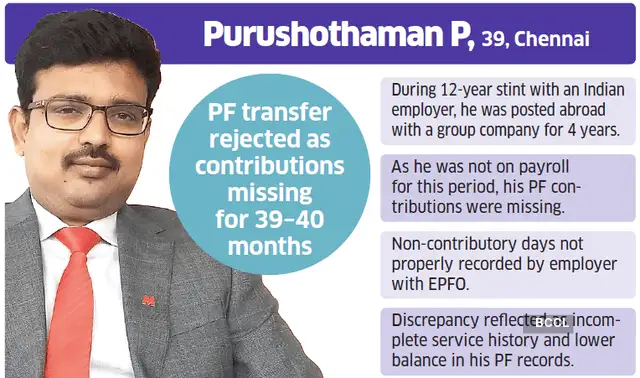

Often, the missing contributions may be owing to simple administrative errors. Chennai-based Purushothaman P, 39, worked with an IT services company for 12 years from 2010 to 2022. During this stint, he was posted abroad with the same employer’s group company for nearly four years.

Since he was not on the payroll of the Indian company during this period, his records show a gap in PF contributions of 40 months. The nature of this gap, or non-contributory period, was not properly recorded by the employer on the Employees’ Provident Fund Organisation (EPFO) portal. This discrepancy reflected as incomplete service history and a lower visible PF balance in his PF records. For this reason, his EPF transfer request was later rejected.

In Purushothaman’s case, the matter got resolved quickly as his employer issued a letter to the EPFO, citing the reason for the gap in contributions. This was sufficient for the EPFO to approve his transfer. “Written clarification from my employer was required to mark the days of non-contributory period in my PF records,” says Purushothaman.

In another instance, when Nitin Prakash of New Delhi applied for PF withdrawal after leaving his employer in December 2024, he found that the latter’s PF contributions were only credited up to October. The employer had deposited November and December dues belatedly in January 2025 as part of the final settlement. This discrepancy between the date of exit and contribution timeline prevented Prakash from initiating his final PF withdrawal.

In recent years, there have been several media reports of companies failing to deposit money in the EPF account of employees. “Instances of missing or delayed contributions are increasing and affecting employees’ provident fund savings,” observes Vikash Jain, Co-founder, Share Samadhan. “This may be due to sheer negligence by the employer or could be intentional in some cases, such as when the company is in financial distress.”

For instance, airline SpiceJet was in the news last July for not depositing EPF dues of its staff since January 2022. Employees at Byju’s (Think and Learn Pvt Ltd) had accused the edtech company of not depositing PF contributions, despite the same being deducted from their pay. Byju’s reportedly made the payment later after much delay.

The rise in such episodes last year led to the EPFO issuing a stern warning to employers. Experts have also noted that missed payments need not just happen with cashstrapped or troubled employers; even healthy companies can miss their share of EPF contributions, due to negligence.

Employers defaulting on PF contributions are liable to pay damages and interest on the amount due. As per sections 7Q and 14B of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, the employer is liable to pay damages and higher interest rate on amount due from him.

The damages and penalty rates differ according to the duration of the delay. If the duration of default is less than two months, the employer has to pay 5% per annum of the total contribution to the employee’s fund. A default of 2-4 months will incur damages at 10% per annum, which rises to 15% for delays up to 4-6 months. If the employer fails to deposit PF dues for over six months, the penalty is 25% per annum of the total contribution. However, the damages are restricted up to 100% of the amount due. Simple interest at 12% per annum is payable on the due amount for the entire period of delay.

How to keep track of your EPF contributions

EPFO portal

STEP 1

Visit the EPFO portal and click on the ‘For Employees’ section under the ‘Services’ section on top of the page.

STEP 2

Click on ‘Member Passbook’ under ‘Services’.

STEP 3

Enter your UAN and password. Fill in the captcha and sign in.

STEP 4

A six-digit OTP will be sent to your Aadhaarlinked phone number.

STEP 5

Enter the OTP and click ‘Verify’. Your PF account balance will be displayed on the screen.

NOTE: You can check your EPF balance on the EPFO portal only if your UAN is activated and registered on the portal.

UMANG app

STEP 1

Log in to the UMANG app by clicking on the profile picture. Select ‘Services’ and click on the ‘Social Security’ option.

STEP 2

Click on ‘EPFO’ option from the list of services.

STEP 3

Under ‘Employee Centric Service’, click on ‘View Passbook’

STEP 4

Enter your UAN number. You will receive an OTP on your registered mobile number.

STEP 5

Enter the OTP received on your mobile and click on the ‘Submit’ button.

STEP 6

Click on the company for which you want to view and download the EPF passbook. The passbook will be displayed on the screen.

Source: ClearTax

Erroneous contributions

Incorrect contributions is another problem area. Your employer may inadvertently deposit a lower or higher amount to your EPF account. “Often, PF contribution amount deposited by the employer does not match as per the rules, which can create problems for the employee,” asserts Kanekar.

Sometimes, simple accounting errors may lead to erroneous PF contributions. For instance, an employee who gets a salary hike in April may receive the higher salary payout, but the payroll team may continue depositing PF as per old salary.

In many instances, errors creep into EPS (Employee Pension Scheme) contributions. Under the EPF rules, 8.33% of the 12% employer contribution is diverted to fund the EPS, subject to a monthly wage ceiling of Rs.15,000. Currently, a maximum contribution of Rs.1,250 per month is deposited to the employee’s EPS account. Sometimes, the employer may inadvertently skip EPS contributions or deposit the wrong amount.

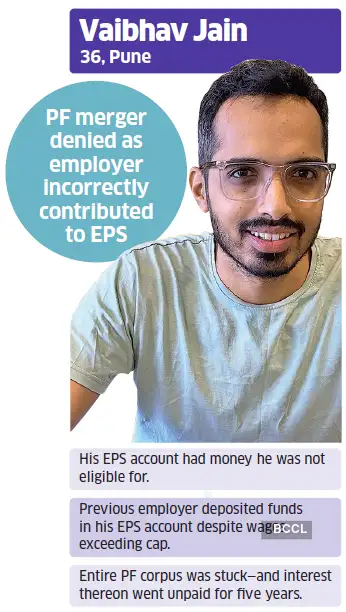

When Pune-based chartered accountant Vaibhav Jain, 35, switched jobs in 2019, his PF transfer from the previous employer got rejected, as his EPS account had money he was not eligible for. Since 2014, new members are not eligible to enrol in the pension scheme of EPF if their monthly pay exceeds Rs.15,000. Jain’s previous employer had mistakenly continued to deduct money towards EPS for three years even though his wages exceeded the ceiling. This resulted in his PF transfer getting blocked. For five years, Jain’s entire PF corpus was stuck—and interest thereon went unpaid—as he ran from pillar to post in many failed attempts to get his passbook reconciled. He finally got his PF transfer processed towards the end of last year, along with unpaid arrears.

How to rectify gaps

Experts insist that the onus is on employees to remain vigilant about discrepancies in their PF contributions.

“Regular monitoring by the employee is required for early detection of these issues,” says Jain, adding, “The employee often realises the gaps only at the time of applying for withdrawal or transfer, at which point it may be difficult even for the employer to correct the records.”

If this sounds like a task, don’t fret. Missing or delayed contributions are fairly easy to spot. Here is what you can do.

Checking your passbook on the EPFO portal or UMANG app to keep tabs on the deposits to your EPF account on a monthly basis. Any discrepancy in contributions will be reflected in the passbook. The member must activate his/her UAN to access the e-passbook. Members also receive SMS on their registered mobile phone on credit of monthly contribution to their PF account, though this system unfortunately doesn’t always work. Employees may also verify their salary slips to see if the amounts match with the PF deductions.

If you find any gaps, bring it to your employer’s attention immediately and seek rectification. For record, send a written communication to your HR with evidence of your EPF passbook. “In cases of genuine administrative lapses, the employer may simply clear the dues or issue a clarification letter to the EPFO citing reasons for the gaps,” avers Kanekar.

However, if the employer is non-compliant, you may have to escalate the matter to the EPFO directly. You may file a grievance on the EPF i Grievance Management System (EPFIGMS) portal or file a written complaint with the regional PF authorities. Submit relevant proof that EPF deposits have been deducted but not deposited in the EPF account. Your salary slips and EPF passbook entries should be enough evidence in most cases. If the employer is in default, the EPFO has the power to investigate and seek corrective actions by the employer, failing which it can impose damages and penalties on the company. The EPFO can file a complaint with the police under Section 316 of the Bharatiya Nyaya Sanhita for action against the employer.

If the problem persists, try filing a grievance with the Centralised Public Grievance Redress and Monitoring System (CPGRAMS). Finally, if nothing else works, consider approaching the courts. “If the employer continues to default and refuses to comply, employees can seek legal remedies,” Jain of Share Samadhan remarks.

Depending on the nature of the discrepancy, it may take anywhere between a few weeks to a few years to get the issue resolved. Prolonged delays can severely hamper your financial well-being. Therefore, it is critical that employees remain proactive and monitor their EPF contributions regularly to flag issues well before time.