In response, the Bengaluru company raised its lower-end growth forecast for the fiscal, with revenue expected to expand between 1% and 3% from the earlier 0-3%. The company is also gaining from increased adoption of artificial intelligence, top executives said. AI programmes are improving productivity between 5% and 15% and this is being partly passed on to customers, according to CEO Salil Parekh who struck an optimistic note at the company’s post earnings call on Wednesday.

“We have seen strong performance this quarter,” he said while noting that there have been a lot of discussions on the economy worldwide, however it is “not fully settled”. Reeling from subdued business demand, most of India’s $283 billion IT industry has been struggling with slow revenue growth in the last two years. The post-pandemic macroeconomic uncertainty has been further exacerbated in recent weeks by the US government’s tariff proposals.

Industry leader Tata Consultancy Services has seen weaker earnings as its quarterly revenue declined 1.6% sequentially and 3.1% YoY to Rs 63,437 crore and fell for the third consecutive quarter in dollar terms, dragged down by degrowth in its largest geographies — the US, UK, and Europe.

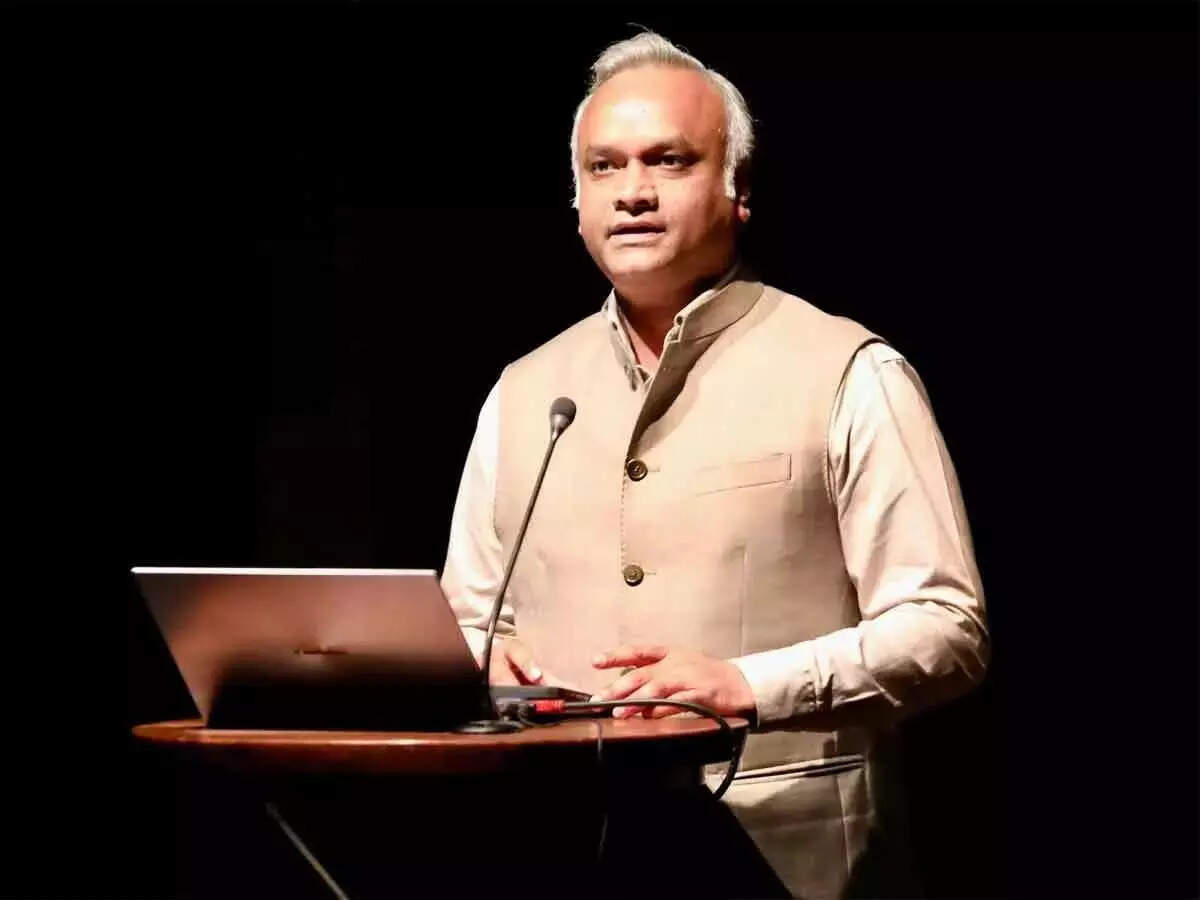

In contrast, Infosys’s strong showing in Europe and robust business from key segments of financial services and manufacturing, as well as 0.4 percentage points of inorganic growth has boosted its revenue even sequentially by 3.3%. “We have a strong deal win. That is the reason why we have increased our lower end from 0 to 1%. At the same time, on the upper end, we still see possible uncertainty on the back of tariffs and on the whole macro environment,” said Infosys chief financial officer Jayesh Sanghrajka.