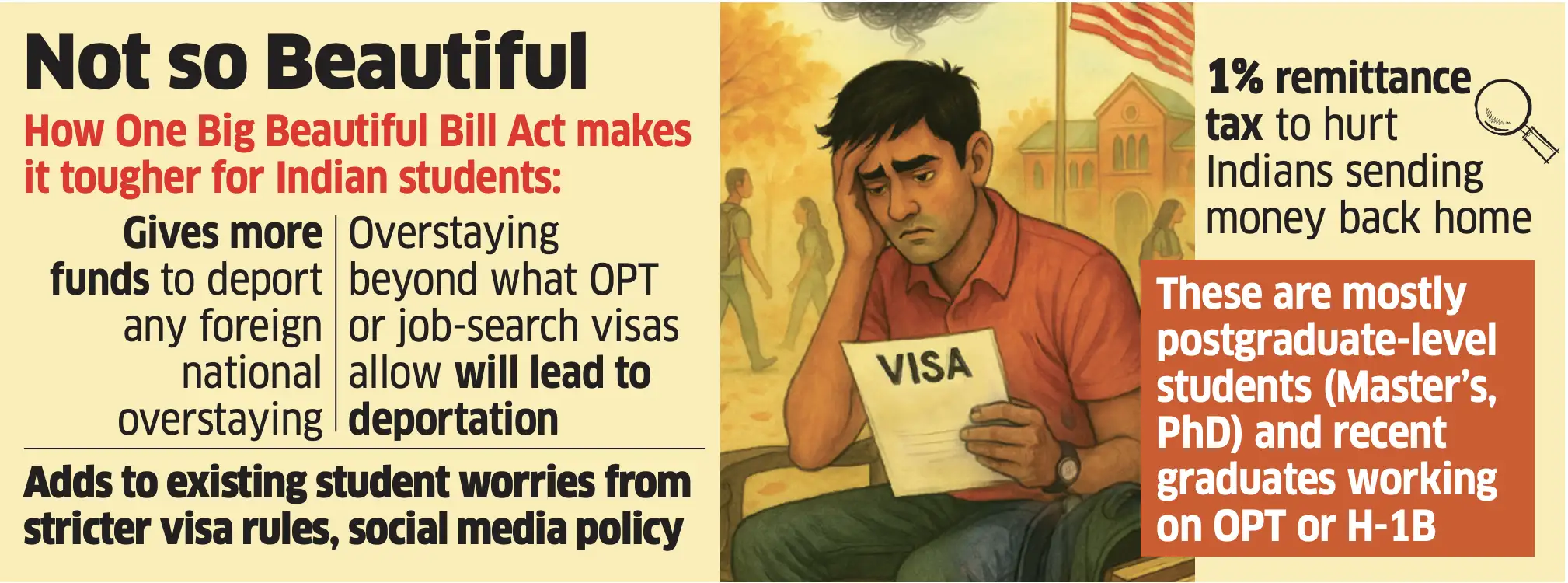

This empowers enforcement agencies to extend their reach into local communities and actively pursue visa overstays, top executives at study abroad platforms said. For Indian graduates on Optional Practical Training (OPT) – a temporary employment authorisation to gain work experience in their field of study – even brief delays in finding work, or overstaying by just one day, could now lead to serious consequences.

In addition, the 1% remittance tax introduced as part of the Act is expected to hit many students who send money back home to support their families or repay loans.

ET Bureau

ET Bureau“Even a small tax can affect low-income students — every dollar counts when supporting tuition or families back home,” said Adarsh Khandelwal, cofounder of Collegify. The tax will apply to foreign remittances made by not just H-1B or green card holders but F-1 student visa holders as well, using cash-like methods (cash, money orders, cashier’s checks). For instance, a $1,000 transfer to India would incur a $10 tax.

Foreign students going on full fee and no scholarship will be spared from the tax, which will apply to transfers made after January 1, 2026.

Tax Troubles & Stricter Screening

Some study abroad experts see the tax as a temporary blip rather than a major deterrent. “A 1% rate is annoying, not prohibitive,” said Nikhil Jain, founder of ForeignAdmits. “Students are resourceful; they’ll adapt by consolidating transfers, exploring digital wallets, or simply factoring it into their budget,” he added.

Manisha Zaveri, joint managing director of Career Mosaic, and Lindsey Lopez, head of US operations at Applyboard, said postgraduate students and recent graduates working on OPT or H-1B often send money to support families, pay off loans, or invest in India.

The tax is just one more source of anxiety for Indian students in the US. Since January, they have been under increasing stress as the new Trump administration started tightening scrutiny of non-immigrant visa holders and deporting illegal immigrants. Stricter visa process and screening of social media posts in recent months have put students on edge. “Students are becoming hypervigilant about everything – their social media presence, their financial transactions, their visa status,” Jain of ForeignAdmits said. “This tax is just adding to the paranoia.”

Students and visa applicants are mostly deleting old social media posts and being extra careful about their online activities, experts said.

Trump’s One Big Beautiful Bill Act also cuts federal support such as Medicaid and SNAP – a federal food purchase assistance funding programme for the poor that has been available to many students as well – to state colleges.

This may force most of these institutions to rely more on full fee-paying international students, who are exempted from the new remittance tax.

However, only a small fraction of Indian students in the US attend Ivy League institutes at full cost. Most are dependent on some form of financial aid or attend mid-tier universities.

Most Indian students looking to study abroad may now consider other destinations, experts said.

“The US may become even more attractive for Ivy League-bound, research-driven students,” said Khandelwal of Collegify. “But mid-tier aspirants may pivot to Canada or Europe, where the welcome mat feels more genuine.”