The issue will be one of the most high-profile listings this year, suggesting that anxieties stemming from US tariffs are calming down.

The IPO comes over a year after Figma’s $20 billion deal to be acquired by Adobe was shelved by regulators.

Here’s all you need to know about Figma and its public offering.

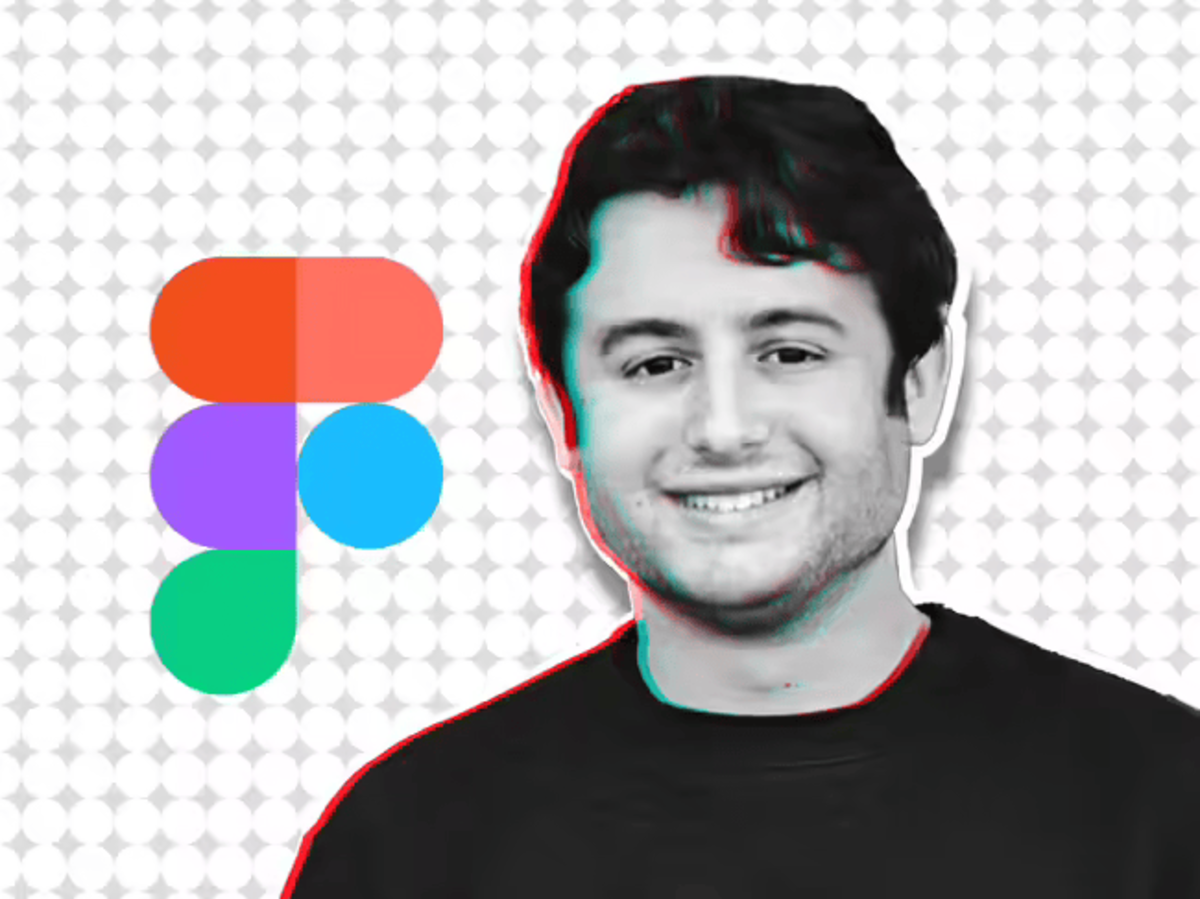

About the company

Figma specialises in collaborative interface design, enabling teams to work together in real time on design projects, much like Google Docs.

Valued at around $12.5 billion, the company has expanded its offerings beyond design to include tools for website creation, AI programming, branded marketing, and digital illustration.

Headquartered in San Francisco, Figma was founded by Dylan Field and Evan Wallace in 2012. Duolingo, Mercado Libre, Netflix, Pentagram Design, ServiceNow, and Stripe are among its major global customers. Indian brands Zomato, Swiggy, Cred and Groww also use its platform.

India market

Field had told ET last November that Figma is keen on tapping India’s vast pool of designers and product developers to better support its customers. He had said around 85% of Figma’s weekly active users are from outside the US, and a substantial number are from India.

“There is a real revenue opportunity in India. It is a myth that you cannot monetise India,” Field had said then, adding that as Figma spends more time in India, it will be able to find areas to improve its services there.

The Adobe deal

In 2022, Photoshop maker Adobe announced plans to acquire Figma for $20 billion. However, last year, the two companies jointly declared the termination of the deal following scrutiny from UK and EU regulators on antitrust issues. Adobe was obligated to pay Figma a reverse termination fee of $1 billion in cash.

Financials

In the aftermath of the Adobe deal fallout, Figma worked on strengthening its books. In the first three months of 2025, it reported $228.2 million in revenue, compared with $156.2 million a year earlier, and its net income jumped threefold to $44.9 million.

In 2024, it had generated $749 million in revenue, a 48% increase from 2023.

The company was profitable in 2023 but reported a large net loss of $732 million in 2024, because of a one-time expense related to issuing 10.5 million stock options to employees. Profit returned in the fourth quarter of 2024, and continued this year.

Figma has raised around $750 million in funding so far from investors such as Sequoia Capital and Andreessen Horowitz.

IPO details

The company plans to list on the New York Stock Exchange (NYSE) under the ticker symbol “FIG”.

Lead banks for the IPO include Morgan Stanley, Goldman Sachs, Allen & Co, and JP Morgan.

The company said it will use the IPO proceeds to fund growth initiatives, double down on AI investments, and repay debt.