Also in the letter:

■ Indian SaaS sector’s growth

■ Foxconn’s rare earths woes

■ Chatter grows around agentic AI

Talent winning out at Indian gaming companies as focus shifts to high-end titles

As Indian gaming studios double down on building ambitious, homegrown IPs—with bigger budgets, slicker visuals, and more intricate gameplay—the race for specialised talent is heating up.

What’s happening?

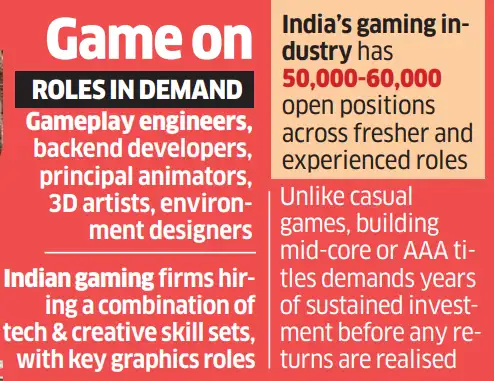

- India’s gaming industry is estimated to have 50,000–60,000 open roles across various experience levels, according to staffing firm TeamLease Digital.

- Studio heads say there’s strong demand for gameplay engineers, backend developers, principal animators, 3D artists, and environment designers.

- Companies such as LightFury Games, SuperGaming and Nodding Heads Games are hiring aggressively across functions.

Reverse brain drain: The talent tide is also turning. SuperGaming has brought back over 25 professionals with stints at global studios like Ubisoft, while LightFury is wooing Indian talent with AAA experience from overseas.

Big hurdles: Nevertheless, scaling a top-tier game studio in India remains a considerable challenge. It requires time, substantial capital, and hard-to-find expertise—particularly in console and PC gaming, industry executives told us.

AI’s role: Artificial intelligence is helping bridge some gaps. Studios say it’s cutting-edge development time and costs. But even the best tools can’t replace what truly matters: creative, collaborative teams building games that people want to play.

Eternal’s Q1 net profit falls 90%, revenue up 70% on Blinkit surge

Albinder Dhindsa, CEO, Blinkit and Deepinder Goyal, CEO, Eternal

Eternal, the parent company of Zomato and Blinkit, saw its net profit tumble 90% year-on-year (YoY) to Rs 25 crore for the June quarter, despite a 70% jump in revenue to Rs 7,167 crore.

Why it matters: The sharp decline is mainly due to increased expenditure on quick commerce and the company’s expanding offline and “going-out” verticals.

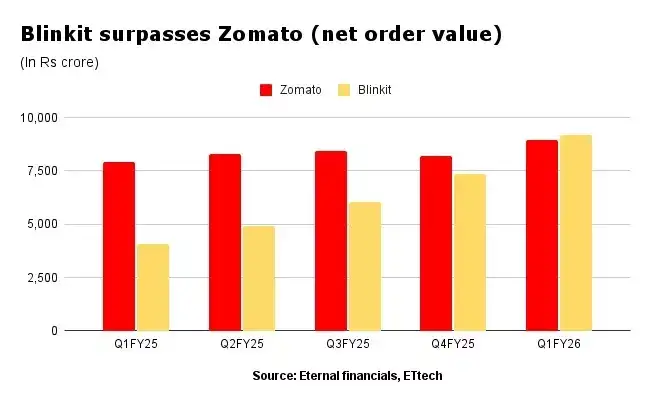

For the first time, Blinkit’s net order value (NOV) overtook Zomato’s food delivery business over an entire quarter. It is a telling shift in Eternal’s growth story—quick commerce now accounts for more than half of its total NOV.

Also Read: Blinkit won’t cede quick commerce market leadership under any circumstance, says Albinder Dhindsa

Key metrics:

- NOV for B2C businesses: Rs 20,183 crore, up 55% YoY

- Adjusted revenue: Rs 7,563 crore, up 67%

- Quick commerce NOV: Rs 10,408 crore

- Food delivery NOV: Rs 9,774 crore

What’s new: Eternal is incorporating a new subsidiary, Blinkit Foods, at a time when it is expanding 10-minute food delivery through “Bistro” kitchens. It currently has 38 such kitchens in Delhi-NCR and Bengaluru, where they produce low-cost meals and snacks, aiming to reach customers within 10 minutes.

CEO Deepinder Goyal said Bistro’s demand is solid and hasn’t hurt Zomato orders, though turning a profit remains a work in progress.

Also Read: No obvious threat, says Eternal CEO Goyal on new entrants in food delivery space

Market response: Shares rose over 7% intraday on the back of strong top-line momentum and Blinkit’s growing scale. This also marks Eternal’s 11th consecutive quarter of 50% or more adjusted revenue growth.

Zoom out: As Blinkit and Swiggy’s Bolt double down on ultra-fast food delivery, profitability remains out of reach. Eternal’s earlier attempts—Zomato Everyday and Quick—failed due to unreliable infrastructure. The competition for quick food dominance continues—but no one has yet cracked the economics.

Also Read: Blinkit plans transition to inventory led model from September 1; pings sellers to switch

Sponsor ETtech Top 5 & Morning Dispatch!

Why it matters: ETtech Top 5 and Morning Dispatch are must-reads for India’s tech and business leaders, including startup founders, investors, policy makers, industry insiders and employees.

The opportunity:

- Reach a highly engaged audience of decision-makers.

- Boost your brand’s visibility among the tech-savvy community.

- Custom sponsorship options to align with your brand’s goals.

What’s next: Interested? Reach out to us at spotlightpartner@timesinternet.in to explore sponsorship opportunities.

India’s SaaS sector tops $15 billion in revenue as IPO pipeline builds

India’s software-as-a-service (SaaS) sector is expanding, with annual revenue exceeding $15 billion in fiscal year 2024, according to a report by JM Financial.

Number-wise:

- The report analysed 250 companies with an annualised recurring revenue (ARR) of at least $10 million.

- 36 companies surpassed $100 million in ARR.

- The SaaS sector grew at a compound annual growth rate (CAGR) of 24% between FY19 and FY24.

- These companies are already profitable and ready for IPOs.

- The report highlighted a significant correction in the valuations of listed SaaS firms.

Vertical SaaS ahead: Horizontal SaaS companies, which provide broad, industry-neutral solutions, still constitute over half of the market. However, vertical SaaS companies, which develop software tailored to specific functions, are expanding at a faster pace, the report added.

Rare earths supply static at Foxconn unit

China’s export curbs on rare earth metals are squeezing supplies at Foxconn’s Telangana plant, slowing production of Apple AirPods, sources told us.

What’s happening:

- The earphones use dysprosium, a rare earth element now in short supply at the Foxconn Interconnect Technology factory near Hyderabad.

- Neodymium, another key component, is used for magnets and is also primarily mined in China. Both metals are essential for compact, high-performance electronics.

Dysprosium isn’t just crucial for gadgets. It also powers laser targeting systems and military-grade communications, which makes it sensitive from a regulatory standpoint.

Also Read: Apple to invest $500 million in rare earths mine operator MP Materials: Report

Flip side: Foxconn has denied any production delays. However, sources said the company has turned to the Telangana government for help. The state has flagged the issue with the Department for Promotion of Industry and Internal Trade (DPIIT), as Foxconn awaits clearances to ship rare earths.

Tell me more: Specifically, it requires an end-user certificate (EUC) attested by central ministries.

- The EUC proves who is receiving the goods and how they will be used.

- While Foxconn has obtained approvals from India’s Ministry of External Affairs and the Chinese embassy, it is still awaiting clearance from Beijing.

China’s great wall: China added seven categories of rare earths, including dysprosium, to its export control list in April in response to US president Donald Trump’s trade actions. Others on the list include: samarium, gadolinium, terbium, lutetium, scandium and yttrium-related items.

Also Read: Alarms ring at speaker, wearables, TV makers on Chinese rare-earth squeeze

Keeping Count

Other Top Stories By Our Reporters

All about agentic AI: Agentic AI, which refers to bots capable of autonomously handling tasks for users, is becoming a key focus in enterprises as they now observe clear use cases and returns on investment in AI, unlike just a few months ago, according to experts.

Escape Plan raises funds: New-age travel accessories platform Escape Plan has secured $5 million in funding, led by Jungle Ventures through First Cheque@Jungle and Fireside Ventures. The round also included participation from other angel investors.

Global Picks We Are Reading

■ New UK AI audit standard aims to crack down on ‘wild west’ operators (FT)

■ Why the world should stop obsessing over LLMs (Rest of World)

■ Tech giants unleash AI on weather forecasts: are they any good? (BBC)