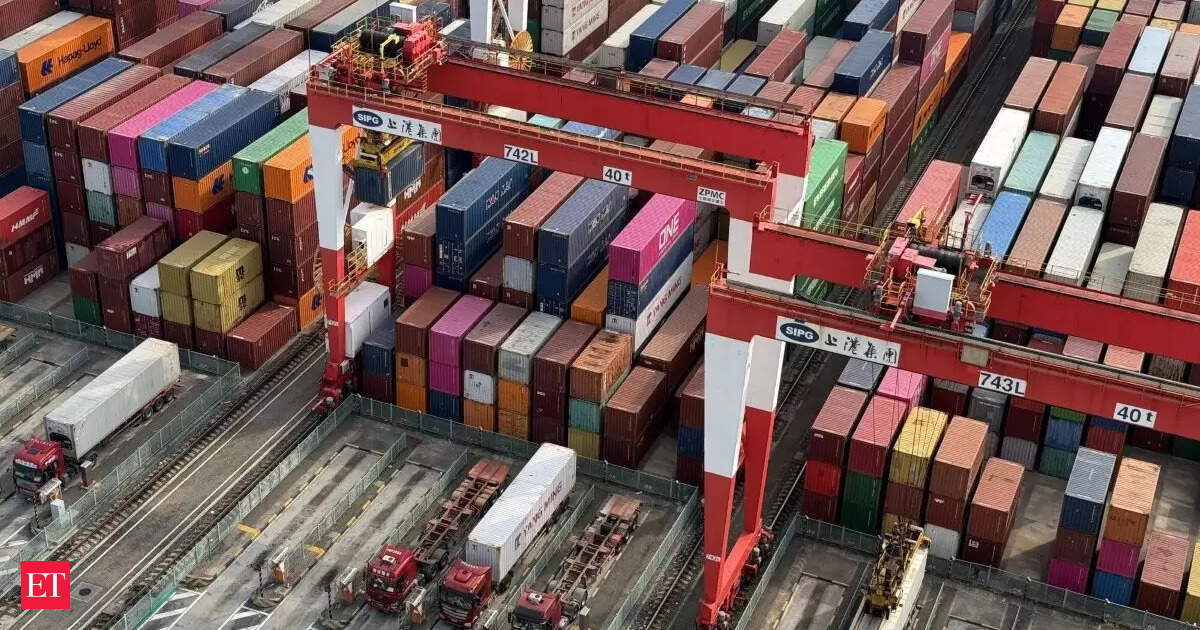

But here’s the problem: while the talk is all about self-reliance, the supply chains still run largely through China.

A win on toys, but with caveats

Let’s start with a rare success. India’s crackdown on toy imports, especially from China, has been one of the few bright spots in its import substitution push.

Between FY2019 and FY2024, toy imports fell nearly 80%, from $304 million to $64.9 million, according to the Global Trade Research Initiative (GTRI).

Imports from China alone dropped from around $263 million to just over $41 million. India raised customs duties from 20% to 70%, mandated BIS certification, and responded to a 2019 QCI report on safety concerns.

At the 16th Toy Biz Expo, Commerce Minister Piyush Goyal called this a textbook example of how assertive policy, standards enforcement, and cluster development can shift an industry. “India’s toy industry, once heavily dependent on imports, is now manufacturing domestically and exporting to 153 countries,” he said.Still, the win isn’t complete. India’s toy exports actually dipped in FY2024, to $152.3 million from $153.9 million the previous year.

And while fewer finished toys are coming from China, most components, LEDs, circuit boards, plastics, packaging, still are. Domestic polymers remain around 10% more expensive, undercutting local competitiveness, as per Polymerupdate in July 2024.

Smartphones: Assembled in India, made in China

Smartphones are another area where India is surging. In FY2025, the country exported $24.1 billion worth, up 55% year-on-year. It’s now the world’s second-largest mobile phone producer, according to the Department of Commerce.

But dig deeper, and the Chinese footprint is hard to ignore. India imported $259.7 million worth of finished smartphones, with 58.8% of them coming from China. More significantly, $7.15 billion worth of smartphone components were imported, 51.7% from China, as per GTRI.

On top of that, smartphone parts alone accounted for $763.8 million in imports, with 55.4% of those from China.

The India Cellular and Electronics Association (ICEA) has warned that Chinese delays in shipments and technician visas could derail India’s ambitious $32 billion export target for FY2026.

“Export-linked manufacturing to the tune of $24 billion in FY25, projected to cross $32 billion in FY26, has now come under serious risk,” the ICEA said in a letter reviewed by The Economic Times.

And Indian firms are still striking deals with Chinese partners.

Dixon Technologies holds majority stakes in Kunshan Q Tech Microelectronics (India) and Chongqing Yuhai India.

While these joint ventures are under scrutiny due to Press Note 3 rules (requiring approval for investments from countries sharing a land border), Dixon’s majority control may help it navigate the approvals.

The bigger issue is that while Apple, Samsung, and Xiaomi (via Foxconn and Wistron) now assemble in India, most core components, chipsets, displays, camera modules, batteries, are still imported.

Also Read: China electronics entry may hinge on tech transfer JVs with Indian firms

The wider web of dependence

Zoom out, and China’s hold only tightens. In electronics and semiconductors, India’s exposure runs deep:

- Silicon wafers: $151.6 million in imports; 96.8% from China

- Flat panel displays: $1.06 billion; 86% from China

- Computer monitors: $376.5 million; 66.8% from China

- Printed circuit boards (PCBs): $612.2 million; 37% from China

- Memory chips: $1.75 billion; 40.5% from China

- Microprocessors: $1.65 billion; 38.2% from China

In consumer electronics:

- Laptops and tablets: $4.45 billion; 80.5% from China

In renewable energy:

- Solar cells: $1.36 billion; 82.7% from China

- Solar panels: $1.7 billion; 78.9% from China

- Lithium-ion batteries: $2.26 billion; 75.2% from China

In pharmaceuticals:

- Erythromycin: $166.3 million; 97.7% from China

- Overall antibiotic imports: 88.1% from China

In industrial and power equipment:

- Embroidery machinery: $351.7 million; 91.4% from China

- Aluminium foil (rolled): $261.2 million; 82.8% from China

- Aluminium plates: $265.4 million; 91.6% from China

- Safety glass: $547.1 million; 84.8% from China

- Battery chargers: $117.3 million; 68.2% from China

- Electric inverters: $200.5 million; 72.3% from China

- UPS/Inverter systems: $641.7 million; 49.9% from China

In June 2025, Chinese battery giant CATL reportedly ordered all its engineers to withdraw from Foxconn’s Chennai plant.

The move disrupted timelines and stalled India’s EV and electronics supply chain build-out.

Beijing has also told Chinese-origin workers employed in Indian or Taiwanese firms to return, cutting off tech transfer and workforce training.

GTRI’s founder Ajay Srivastava summed it up: “China’s actions may be signalling to avoid any conditions in the FTA that discourage the use of Chinese-origin components in exports to the US. China’s message is blunt: India’s industrial growth remains dangerously exposed to Chinese inputs, and any attempt to ‘de-risk’ supply chains will carry short-term pain.”

Also Read: China begins work on Brahmaputra Dam in Tibet, raising fears of a ‘ticking water bomb’ in India

Trade numbers tell the story

India’s trade deficit with China has hit a record high,$99.2 billion in FY2025. Imports were $113.4 billion; exports just $14.2 billion, according to trade data released by the Commerce Ministry.

That gives India only an 11.2% share in bilateral trade, down sharply from 40% two decades ago.

And just as India tries to expand in semiconductors, EVs, and solar, China is tightening its grip on gallium, germanium, and graphite, all essential for these industries. In July 2025, India’s battery sector was hit by new Chinese restrictions on graphite exports.

“The pressure mounted further in June 2025, when Chinese battery giant CATL reportedly directed Foxconn to withdraw all Chinese engineers from its manufacturing unit near Chennai. The move disrupted timelines and coordination at a crucial time for India’s electronics and EV supply chain buildout,” GTRI Founder Ajay Srivastava said.

So, can India decouple?

Not anytime soon.

However, India’s Union Cabinet has approved a PLI scheme worth ₹22,919 crore for the manufacturing of electronic components in April 2025 to localise electronic components, aiming to create 91,000 new jobs.

The Micron-backed $2.75 billion semiconductor fab in Gujarat also shows promise.

But shifting from Chinese to Japanese or Korean suppliers can be up to 4x more expensive. And India still faces its own legacy hurdles: uneven infrastructure, skill shortages, and red tape.

The paradox of self-reliance

Here’s the contradiction at the heart of it all: as India pushes harder to manufacture, it ends up importing more from China, not less. Assembly is happening in India, but the guts, the brains and the bones, still come from abroad.

Import substitution has worked in a few areas like toys, but high-tech and capital goods remain dependent on Chinese supply chains. India is still a long way from decoupling.

The ambition is real. But until India builds its own supply chain from the ground up, Make in India will remain a label, stitched on with Chinese thread.