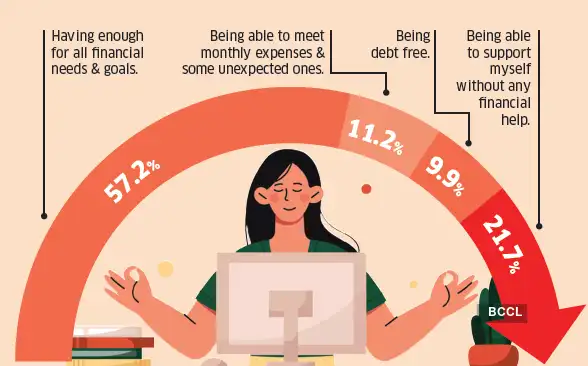

What financial independence truly entails

- Planning for long-term goals like retirement or a child’s education.

- Preparing for emergencies or job loss.

- Making informed investment decisions, not just saving reactively.

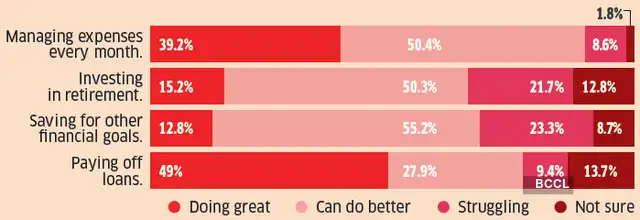

Confidence about core money tasks

Even among women who are earning or saving, there’s a deep undercurrent of financial insecurity — a feeling of not being ‘ready enough’.

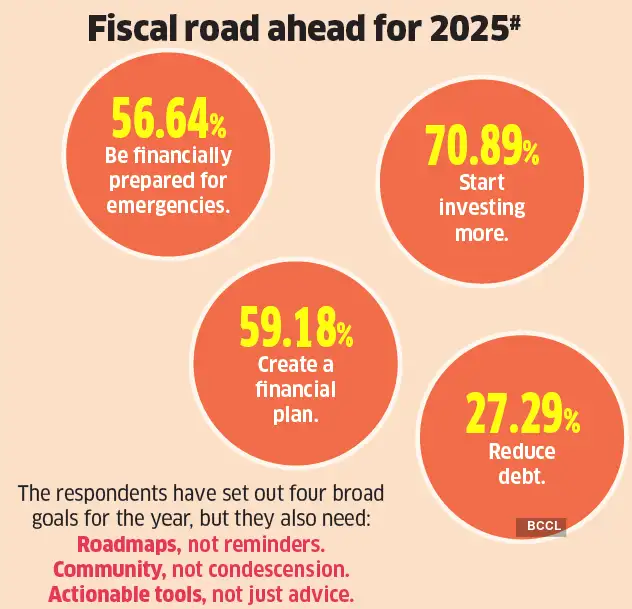

Source: The Women & Finances Survey 2025 reached out to over 800 women across the country to understand how they perceive financial independence, manage money, invest, and plan for their future. #Figures don’t add up to 100% due to multiple responses

Major financial concerns

46.1%

Unsure of having enough for emergencies.

20.4%

Finding it difficult to save.

9.3%

No worries

62.7%

Unsure of having enough for personal needs and goals.

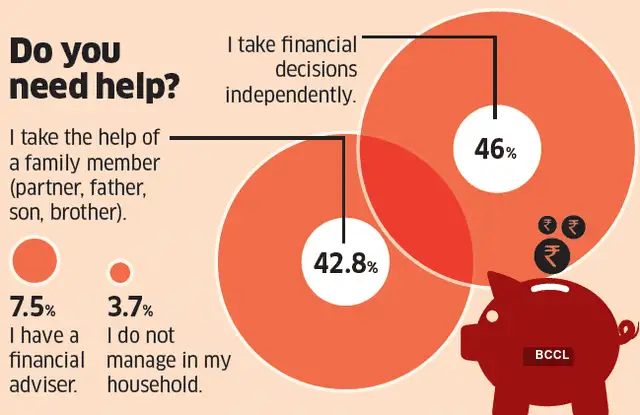

Do you need help?

Women’s top investment choices

Traditional products like fixed deposits & insurance policies

31.9%

Shares

10.99%

Mutual funds

38.9%

Gold

18.2%