Also in the letter:

■ Bulls pay Paytm a visit

■ Meta’s at it again

■ Intel’s axe hits more

Wipro Q1 profit rises 11% YoY; CEO says AI now central to clients

Srini Pallia, CEO, Wipro

In a sluggish IT spending climate, Wipro’s topline stayed muted in the June quarter, but strong deal momentum offered a silver lining.

Snapshot:

- Net profit: up 11% YoY and down 6.7% QoQ to Rs 3,330 crore, and just ahead of expectations.

- Revenue: marginal rise to Rs 22,134 crore.

- Interim dividend: Rs 5 per share; record date is July 28.

- Total deal wins: $4.97 billion, up 50.7% YoY in constant currency; large deals more than doubled to $2.7 billion.

Strategic lens: CEO Srini Pallia flagged ongoing macro uncertainty but noted rising demand for cost efficiency and AI-led transformation. “AI is no longer experimental, it’s central to our clients’ strategies,” he said.

- Operating margin in the IT services business rose to 17.3%, up 80 basis points.

- Cash flow came in strong at Rs 4,110 crore, 123% of net profit.

Outlook: Wipro expects flat to 1% sequential growth in Q2FY26.

Also Read: LTIMindtree Q1 Results: Cons profit jumps 11% YoY to Rs 1,255 crore; revenue up 8%

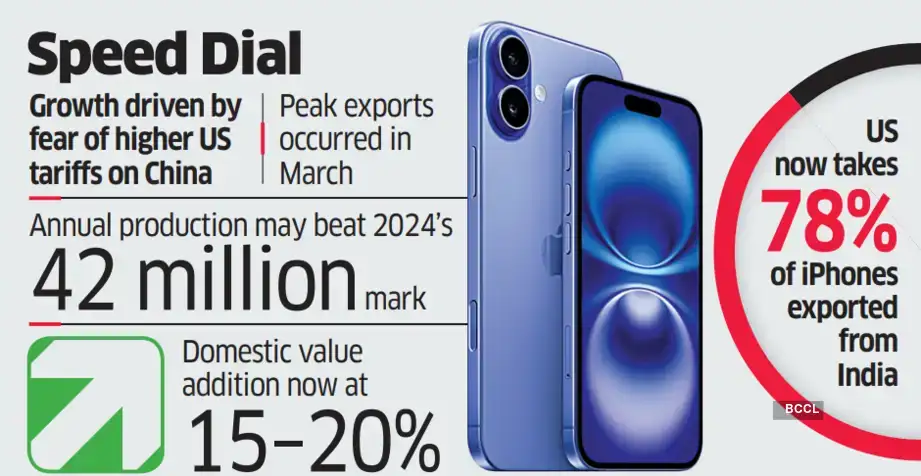

Apple’s iPhone output in India hits all-time high

India has emerged as a key pillar of Apple’s global manufacturing strategy as tariff threats loom and supply chains shift.

What’s happening:

- iPhone production in India jumped 53% year-on-year in H1 2025 to 23.9 million units, according to Canalys.

- Exports surged to $22.56 billion, up from $14.71 billion a year ago, according to CMR.

Apple increased shipments to the US in anticipation of a potential 26% tariff on India-made goods (imports), a move now postponed until August 1, as the two nations near an interim bilateral trade agreement.

- India now accounts for 78% of Apple’s iPhone exports, up from 53% last year, Canalys added.

- Foxconn drove most of the exports, while Tata Electronics, which now runs Wistron and Pegatron’s local operations, accounted for 4 in every 10 iPhones shipped.

What’s next: Trial runs of the iPhone 17 are in progress at Foxconn’s Tamil Nadu plant, indicating a simultaneous launch with China. Annual production is projected to exceed 42 million units in 2024.

Also Read: Meet the firms taking a big bite of Apple’s India manufacturing pie

Sponsor ETtech Top 5 & Morning Dispatch!

Why it matters: ETtech Top 5 and Morning Dispatch are must-reads for India’s tech and business leaders, including startup founders, investors, policy makers, industry insiders and employees.

The opportunity:

- Reach a highly engaged audience of decision-makers.

- Boost your brand’s visibility among the tech-savvy community.

- Custom sponsorship options to align with your brand’s goals.

What’s next: Interested? Reach out to us at spotlightpartner@timesinternet.in to explore sponsorship opportunities.

Paytm stock back at Rs 1,000 as UPI and lending drive rebound

Investors are warming up to Paytm again as the company steadies itself after last year’s regulatory jolt. UPI onboarding is back on track, and the lending business is showing momentum.

- The stock crossed Rs 1,000 this week for the first time in six months.

- Contribution margin (excluding UPI incentives) rose to 54%, thanks to stronger financial services revenue.

- Paytm is now onboarding UPI users through Yes Bank, SBI, Axis, and HDFC Bank, following an eight-month freeze that ended last October.

Source: Google

By the numbers:

- Net loss for Q4FY25 narrowed slightly to Rs 540 crore from Rs 550 crore a year ago.

- Revenue dipped 16% year-on-year to Rs 1,912 crore, mainly due to the exit from wallet operations.

- The stock is now trading close to its 52-week high of Rs 1,063.

What to watch: Paytm will report its Q1FY26 results on July 22. Analysts are watching for continued strength in merchant lending and loan disbursements.

Ixigo shares hit upper price limit after Q1 results

Le Travenues Technology, the parent company of travel platform Ixigo, saw its shares hit the 20% upper circuit on Thursday after reporting strong financial results for the June quarter.

By the numbers:

- Revenue: at Rs 314 crore, up 73% YoY.

- Net profit: increased 27% to Rs 19 crore.

- Gross transaction value: surged 55% YoY to Rs 4,645 crore.

Meta raids OpenAI again for elite AI talent

Meta isn’t done raiding rival labs just yet. After a short breather, the Mark Zuckerberg-led giant is back at OpenAI’s doorstep to shore up its new, high-stakes AI bet.

Catch up fast: Wired reported that two senior OpenAI researchers, Jason Wei and Hyung Won Chung, are joining the Meta Superintelligence Lab, the group building AI systems that can surpass human intelligence.

- Wei was instrumental in developing the o1 model and helped pioneer chain-of-thought prompting, a key breakthrough in reasoning.

- Chung led training for Codex mini and worked on OpenAI’s agentic reasoning tools.

- Together, they shaped some of OpenAI’s most advanced research efforts and represent key IP, leaving the Sam Altman-led firm.

Zoom out: Meta has been dangling long-term packages worth up to $300 million to lure elite AI researchers. Wei and Chung follow a growing list of OpenAI veterans who have switched to Meta, Anthropic, and xAI.

Also Read: Top AI talent attracted not just by paycheques: Meta CEO Mark Zuckerberg

However, OpenAI isn’t sitting idle. It is quietly restocking its bench, pulling in talent from Meta, Tesla, and other Silicon Valley giants.

Zuckerberg to testify in $8 billion privacy trial

Meta CEO Mark Zuckerberg will take the stand in an $8 billion shareholder lawsuit related to the Cambridge Analytica scandal. This marks a rare moment of personal accountability for Big Tech’s leading figures, including Sheryl Sandberg, Marc Andreessen, and Peter Thiel.

Investors allege that Meta misled them about privacy risks and failed to comply with a 2012 FTC consent decree, leading to billions in fines and global repercussions.

Intel’s layoff wave swells past 5,500 as AI race widens gap with rivals

US chipmaker Intel is doubling down on job cuts as it scrambles to stay relevant in the AI age

What’s happening: The chipmaker is letting go of more than 5,500 staff in the US, up from earlier estimates of 4,000, according to state WARN filings. The deepest cuts are in California, Oregon, and Arizona:

- Oregon: 2,932 jobs cut, nearly four times more than planned

- California: 1,935 roles gone, double earlier estimates

- Arizona: 696 layoffs

Why it matters: New CEO Lip-Bu Tan is aiming for a 20% workforce reduction to speed up decision-making and close the cap with Nvidia and AMD.

Between the lines: Tan admitted to staff that Intel is no longer a top-10 semiconductor player and that it had fallen behind in the high-stakes AI chip race. “On training, I think it is too late for us,” he said, pointing to Nvidia’s dominance with customers like Meta, OpenAI, and xAI.

By the numbers: Intel’s market cap is down to $103 billion, while Nvidia just hit $4 trillion valuation. Early response to Intel’s next-gen chip, 18A, has been underwhelming.